Financing the net-zero transition

|

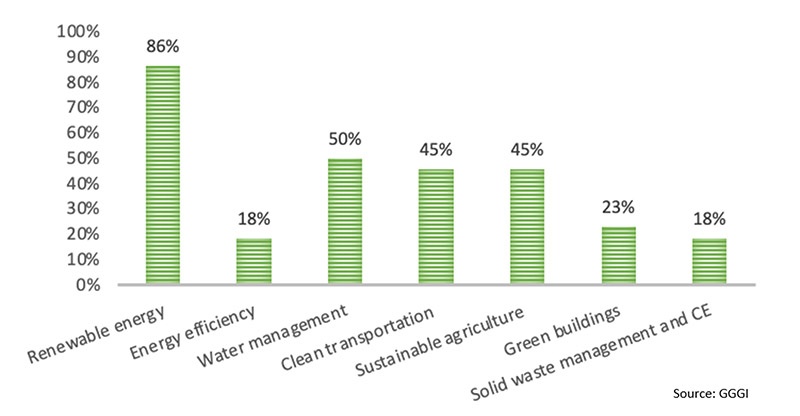

| Top sectors for green investment in the next three years |

As Vietnam looks to retain its position among the top-performing economies in the region, there has been growing emphasis on addressing the pressing environmental and developmental challenges for greener growth and a more sustainable future.

By the World Bank’s estimation, Vietnam needs $368 billion from now until 2040 to build a climate-resilient and low-carbon economy. To meet Vietnam’s ambitious Nationally Determined Contributions, besides state resources, the country needs to mobilise an additional $35 billion this decade, and the economy may only meet around a third of the financial need.

|

| Srinath Komarina, programme manager at the Global Green Growth Institute in Vietnam |

Addressing the climate funding shortfall is now, even more, a matter of urgency as Vietnam joined other forward-thinking countries to adopt a net-zero emissions target by 2050, a commitment reaffirmed by Prime Minister Pham Minh Chinh at COP26 last year.

The prime minister’s strategic direction is offering Vietnam an opportunity to take the lead in developing economies in green and sustainable transition, and its success will position Vietnam at the forefront of rapidly emerging green industries and job opportunities.

Such ambition calls for the development of new and innovative mechanisms for mobilising finance towards sustainable sectors and businesses which not only meet the developmental agenda of Vietnam but also deliver on climate targets.

In recent years, the Vietnamese government has made efforts to support climate-friendly technologies like renewable energy, green buildings, and e-mobility, amongst many others. It is notable that these new sectors are at different stages of development, requiring customised support and resources to thrive and deliver on the promise of low carbon emissions.

This, however, presents significant opportunities for green finance to help bridge the investment gap. The financial markets are uniquely positioned to provide these new sectors with the much-needed long-term risk-taking capital to fund the green transition.

Financing change

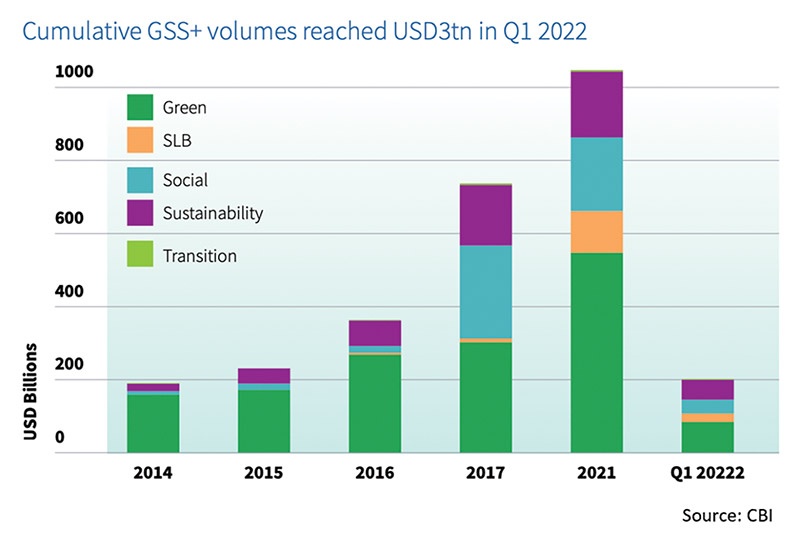

Globally, sustainable finance is one of the fastest-growing segments. Bloomberg estimates that sustainable debt issuance surged to $1.6 trillion in 2021, with more than $4 trillion cumulative issuance in sustainable debt issued since market inception.

While there are new instruments in the sustainable finance landscape that are catching the attention of both investors and issuers, one of the well-established mechanisms driving the global economy’s transition to a greener future is green bonds.

Green bonds are very similar to conventional bonds, with the added feature that the capital raised must be used for projects which deliver environmental benefits, and only as classified by internationally or regionally accepted principles such as the International Capital Market Association’s Green Bond Principles, the Climate Bonds Initiative’s Climate Bonds Standard, or ASEAN’s Green Bonds Standards.

Since the first green bond in 2007, the market has grown exponentially every year, with cumulative issuances pegged at over $1.6 trillion globally. A growing number of corporates and financial institutions have been able to attract foreign and domestic investments using green bonds, demonstrating how innovations in emerging markets have the potential to capture global attention.

Closer to home in ASEAN, the cumulative green deals that originated from the ASEAN-6 countries stood at $39.4 billion at the end of 2021, contributing 72 per cent to the cumulative total green social and sustainable issuances between 2016 and 2021.

|

Opportunities abound

In Vietnam, visibility and awareness of green bonds are on the rise. As per the market survey “Potential of Green Bonds in Vietnam 2021” conducted by the Global Green Growth Institute (GGGI) last year, market awareness has markedly improved among investors, though still at an early stage for underwriters and other market participants.

In the first edition of this survey in 2020, while 80 per cent of respondents indicated that they were still at this early stage, this year, half of the surveyed investors are either planning to develop a green bond agenda or have established their green bond plans.

The survey also highlighted that renewable energy, water management, clean transportation, and sustainable agriculture are sectors with the highest potential for green investment in the next three years.

A recent example of growing investor confidence in the local market is the successful issuance of the first onshore, verified green bond in Vietnam by EVN Finance, with technical advice from the GGGI, to the tune of $75 million, which was privately placed by institutional investors in the country.

The proceeds will be used for eligible green projects, including loans toward the fast-growing renewable energy and energy efficiency sectors in Vietnam. With a positive response from the market, this issuance is expected to set a precedent for more green bond issuances in the near term.

The deepening of Vietnam’s sustainable finance market can benefit not only just private players – but municipalities can also tap into this emerging market to fund their green infrastructure projects.

Realising the potential benefits of green bonds as an important enabler for sustainability efforts, the Vietnamese Ministry of Finance, with support from development partners like the GGGI as part of its Vietnam Green Bond Readiness programme, has been working on pilot issuances to kickstart the market.

This market development includes capacity building of all stakeholders in the ecosystem, coupled with policy work on green bond guidelines. The Vietnamese government’s resolve in developing a robust sustainable finance market domestically is of great importance, and it would send the right signals to both the issuers and investors.

The development of a robust green bond market in Vietnam can provide a strong boost to green projects and have important multiplier effects on the creation of green jobs and economic activities, addressing environmental problems and thus pave the road for a green transition of the economy.

Sustainable finance would be a great opportunity for Vietnam to transition towards becoming an environmentally sustainable and climate-resilient economic powerhouse and, this way, achieve its goal of net-zero greenhouse gas emissions by 2050.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

Tag:

Tag:

Mobile Version

Mobile Version