Exporters take advantage of global deals to expand reach

|

The Ministry of Industry and Trade (MoIT) last week reported to the National Assembly Economic Committee that international economic integration featured via free trade agreements (FTAs) has been enabling Vietnam to achieve significant export performance.

Total export turnover has increased from $215.1 billion in 2017 to $371.7 billion in 2022, and $259.67 billion in the first nine months of this year. This is an annual average growth rate of 11.6 per cent for the 2018-2022 period (see box).

“Export turnover rising has made an important contribution to GDP growth, macroeconomic stability, exchange rate stability, and improvement of payment balance,” said the MoIT’s Foreign Trade Agency. “Moreover, Vietnam’s export markets have been swollen extensively.”

By late 2018, Vietnam had only 31 markets with an export turnover of more than $1 billion. However, the number of such markets rose to 34 by late last year, including two with an export turnover of over $50 billion - they are the US ($109.4 billion), and China ($57.94 billion).

Additionally, the number of items with an export turnover of $1 billion rose from 29 in 2018 to 36 last year, accounting for 94 per cent of the country’s total export value.

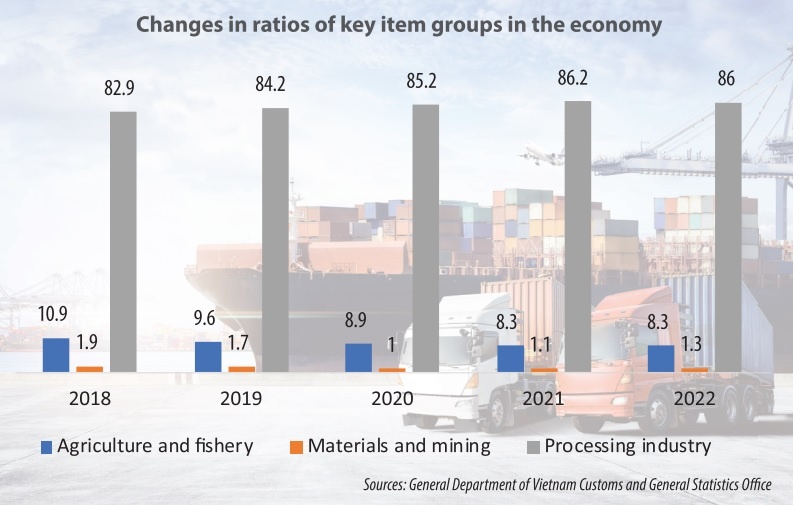

“The structure of export items has been improved towards modernisation and industrialisation, with a big rise in the ratio of items with high added value and high technology content,” the agency said (see chart).

“The export structure has shifted towards an increase in the ratio of industrial processing items, which are also the group of items with the quickest rise in the structure, and also are the determinant that has created a breakthrough in export turnover,” the agency said.

In 2017, Vietnam was the 20th largest exporter in the world. However, the rank rose to 18th last year.

Besides an increase in export items, exporters in Vietnam have taken advantage of FTAs to develop export markets. The total export turnover from the usage of priorities under FTA commitments has averaged at 35-40 per cent of total export turnover from partner markets, according to the MoIT.

Due to massive difficulties, Vietnam’s nine-month export turnover declined 8.2 per cent as compared to the same period last year.

The MoIT has issued a warning that Vietnam’s exports may be hurt by a grey global economic situation, featured by a slash in demands.

“A danger of economic depression, high inflation, and high interest rates will lead to a plummet in demand for consumption in many nations, including those in Europe and also the US,” said another MoIT report on Vietnam’s trade.

According to the MoIT, trade protectionism in many nations is increasing and developed nations are paying more attention to safety for their consumers and to sustainable development and fight against climate change. Therefore, they have and will continue applying new regulations and standards regarding supply chains, materials, labour, and environment for imported products.

|

For example, the EU has applied an anti-deforestation bill and a carbon border adjustment mechanism, while the US has and will continue increasing and stick standards about labour, environment, and intellectual property to trade. In fact, in the first half of 2023, the EU has applied a new regulation on environmental protection with a focus laid on reducing emissions from products in textiles and garments, footwear, and electronics.

In January, the European Commission amended regulations on the temporary rise in official controls and emergency measures governing the entry into the EU of certain goods from third countries. Under this new regulation, some of Vietnamese products have been affected, including chilli and okra, which a quality examination frequency rate of 50 per cent.

“Various supply chain due diligence schemes already govern the placing of goods on the EU market, and new EU regulations are about to enter into force,” said Alexander Koch, chairman of the Dutch Business Association in Vietnam. “All of these schemes require exporters to be able to present documentary evidence upon request to demonstrate their compliance to sustainable environmental, social, and governance criteria.”

Investing in such reporting is essential for companies exporting from Vietnam to the EU or being in the supply chain of an EU company to enjoy low tariffs and easy access to EU markets, he added.

For example, the garment and textile industry is now scratching its head over meeting related standards from Europe, which used $4.46 billion importing Vietnam’s garments and textiles last year.

“The Russia-Ukraine conflict will also affect the industry, as Vietnam exports a large volume to both. In addition, the price of materials has also increased 20 per cent on average, and the situation is expected to continue in the coming months,” said Truong Van Cam, vice chairman of the Vietnam Textile and Apparel Association.

The garment and textile sector hit an export turnover of $26.1 billion in the first eight months of 2023, down 16 per cent on-year. A number of other key export industries also faced the same plight, such as mobile phones and their spare parts at $36.15 billion, down 1.5 per cent; electronics products and their spare parts at $33.94 billion, down 15.4 per cent; and footwear $13.48 billion, down 17.6 per cent, the MoIT reported.

The MoIT noted, “Whether Vietnam can expand its exports will depend on the country’s ability in diversifying export markets and taking advantage of opportunities from free trade agreements, and settling risks from trade and technological competition among big countries.”

| Exporters being stifled by VAT tweaks The constant changes of requirements for verification of records and invoices are being called too challenging for exporters, with businesses complaining that VAT refund procedures are becoming more baffling. |

| Wood exporters pleading for VAT refund resolution Central-run authorities have given drastic directions to speed up VAT refunds for numerous businesses, especially struggling wood exporters. |

| Promising conditions yet within reach for local exporters Although there have been several improvements in recent months, global economic headwinds could still blow Vietnam’s exports off course. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

- Vietnam entering a new growth phase in 2026 (January 28, 2026 | 10:02)

- VIMC targets higher profit and throughput in 2026 (January 26, 2026 | 19:00)

- GEVA a launchpad for Vietnam’s agricultural exports (January 26, 2026 | 12:03)

- Data-driven risk management signals major shift in customs administration (January 24, 2026 | 11:22)

- Cosmetics rules set for overhaul under draft decree (January 24, 2026 | 11:21)

- Vietnam Airlines seeks aircraft through dry lease (January 22, 2026 | 20:43)

- Policy obstacles being addressed in drug licensing and renewal (January 22, 2026 | 20:17)

- Vietnam’s wood exports surpass $17 billion (January 22, 2026 | 20:15)

Tag:

Tag:

Mobile Version

Mobile Version