Exploring the aspects of global gold performance

|

| Dat Tong, Senior market strategist, Exness |

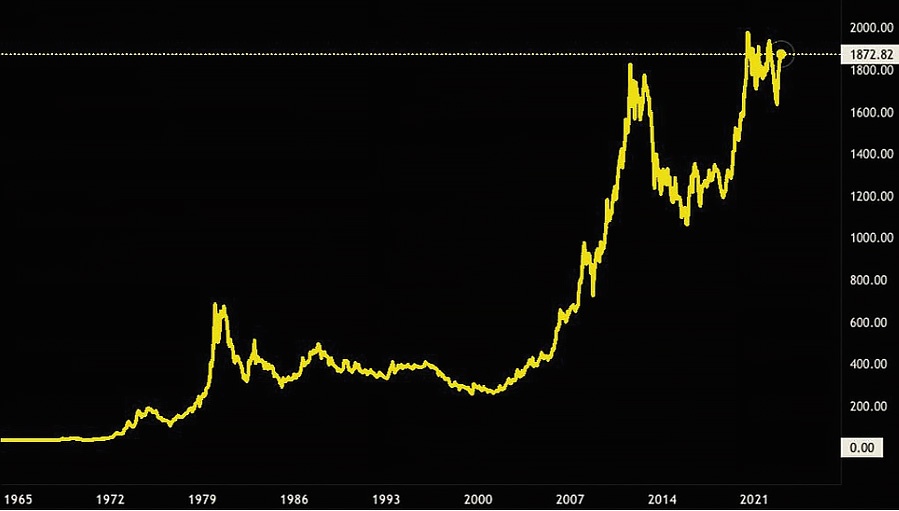

With financial turmoil on the rise around the world, many traders are looking to gold as a safe-haven asset. Gold has been on the rise lately, approaching its all-time high in August 2020 (see chart).

The 2009 recession boosted gold trading volume and by 2011, XAUUSD reached a high level at $1,823. As world economies recovered, fiat currencies regained strength and gold prices fell throughout 2013-2014. The downtrend bottomed out at $1,061 in 2015, before starting to ascend.

Gold prices rebounded in 2019 as the pandemic ravaged countries, reaching $1,974.

Is gold still a safe-haven asset? During difficult economic times, gold price tends to increase. This makes gold a good investment for those looking to protect their assets in uncertain times. Gold can act as a hedge against inflation. When inflation increases, XAU usually increases as well.

Scarcity is in gold’s nature, which is another reason why experts consider gold a good investment, regardless of time period or the overall economic health. As the amount of gold in the world is limited, its price will continue to increase as demand increases. The electronic industry relies heavily on gold, and this fact is not going to change anytime soon.

This makes gold a good long-term investment, but traders can also enjoy a boost in the short term.

Despite the recent volatility in the market, gold remains a stable investment. Some experts believe that the first quarter of 2023 is a good time to trade or invest in gold, and that gold will continue to be a safe-haven asset throughout the year and hold its value.

|

| Exploring the aspects of global gold performance |

Global interest rates are expected to rise in 2023, as the economy continues to recover from the pandemic and more importantly, prepares for a possible recession. Higher interest rates are the treasury’s defence against a recession, which often leads to higher gold prices.

A recession can also lead to a shift in investor sentiment. During the 2009 financial crisis, gold prices skyrocketed as investors sought safety from the volatile stock market. There’s no reason to think that 2023 will be any different.

Some experts warn that the price of gold is too volatile and could fall significantly in the coming months. If you are considering trading gold, it is necessary to consider both sides of the arguments before making a decision.

If you are looking for a safe-haven asset to protect your portfolio from market volatility or even hedge against inflation, gold could be a viable option to consider. You may want to wait for the price of gold to stabilise before investing, as the price is already very high.

Ultimately, the decision to invest or not should be up to you and your financial situation. Past market behaviour is not guaranteed to repeat, and volatility can threaten low-capital accounts with high leverage. Trade wisely. Choose your entry point with the help from economic news, fundamental analysis, and technical analysis.

| Gold appeal sparkles amid rise of inflation The latest increase in interest rates by the US Federal Reserve is foreshadowing more rises this year and a long-term strategy to control inflationary pressure – and so institutional demand for gold is also expected to increase. |

| Gold prices plunge on July 18 Vietnam’s gold prices saw a historic one-day fall on July 18, going down by 4 million VND (170 USD) a tael. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version