Euro banks offering green solutions

|

| Euro banks offering green solutions, illustration photo |

As part of a new partnership made last month, HSBC will comprehensively analyse and offer sustainable financing options for the growth of Trung Nam Group’s renewable energy projects in Vietnam.

The bank will draw on its global investment banking franchise, its deeply entrenched presence in the country’s financial market, and its extensive experience in sustainable finance to aid the group’s potential.

Nguyen Tam Thinh, Trung Nam’s chairman said, “This collaboration will generate critical financial solutions, assisting future growth of our strategic projects. Thus, we could increase ownership capacity in renewable energy to 3.8GW and 1.5GW of liquefied natural gas (LNG) by 2025, while also fulfilling the country’s net-zero ambitions.”

According to HSBC Vietnam’s announcement in late January, the bank intends to arrange up to $12 billion in direct and indirect financing for Vietnam and the business sector by 2030. The bank has vowed to invest $750 billion to $1 trillion in financing and investment this decade in order to help customers shift their business models and decarbonise.

HSBC Vietnam would mobilise funds from domestic and international financial markets to provide a variety of sustainable solutions in green finance, debt financing, supply chain management, commerce, green deposits, and investment products.

Standard Chartered Vietnam, another UK-based lender, is likewise devoted to its sustainability path.

T&T Group’s green initiatives in Vietnam will be partially funded by a $6 billion financing agreement from Standard Chartered made in November. Several projects would be the beneficiaries, including the Thai Nguyen province industrial and medical waste treatment plant, a waste treatment plant in Hung Yen, the waste-to-energy Xuan Son power plant in Hanoi, and the Hai Lang LNG project in Quang Tri province with a capacity of 1,500 MW, and other renewable energy projects.

Michele Wee, CEO of Standard Chartered Bank Vietnam said, “We are focused on consistently delivering world-class services and strategic solutions and making a significant difference in the markets we operate in. It is indeed a great pleasure that our efforts here in Vietnam have been recognised.”

A T&T Group spokesman noted that the partnership would unlock medium and long-term financial requirements as well as gain more exceptional know-how to speed up the group’s green projects in Vietnam, thus contributing to the national green growth plan for the period of 2021-2030, with a view to 2050.

Elsewhere, German finance institution DEG, a subsidiary of KfW Group, has invested $10 million in convertible Tier 2 bonds issued by Sovico’s HDBank. The bonds raised will also help HDBank enhance its environmental and social risk management capacity based on international practices. Specifically, HDBank has committed to staying away from coal-related projects.

For the United Nations’ Sustainable Development Goals of clean water, clean energy, industry, innovation, and infrastructure, the combined private sector investment prospect in Vietnam to 2030 is projected at $45.8 billion, cited Standard Chartered’s Opportunity 2030 research.

The World Bank, meanwhile, also predicts that climate change would diminish Vietnam’s national GDP by up to 3.5 per cent by 2050, making it one of the most vulnerable nations in the world.

Vietnam is one of Asia’s most carbon-intensive countries, only after China and Mongolia, and must make a swift transition away from high-carbon sectors in favour of climate change mitigation.

Vietnam’s climate-smart business potential is anticipated to be $753 billion between 2016 and 2030, with the bulk ($571 billion) allocated towards the country’s transportation infrastructure requirements by 2030, according to the IFC Climate Investment Opportunity study.

Renewable energy investment opportunities reach $59 billion, with more than half going to solar photovoltaic technology and another $19 billion to hydropower projects. New green buildings offer a prospect worth around $80 billion.

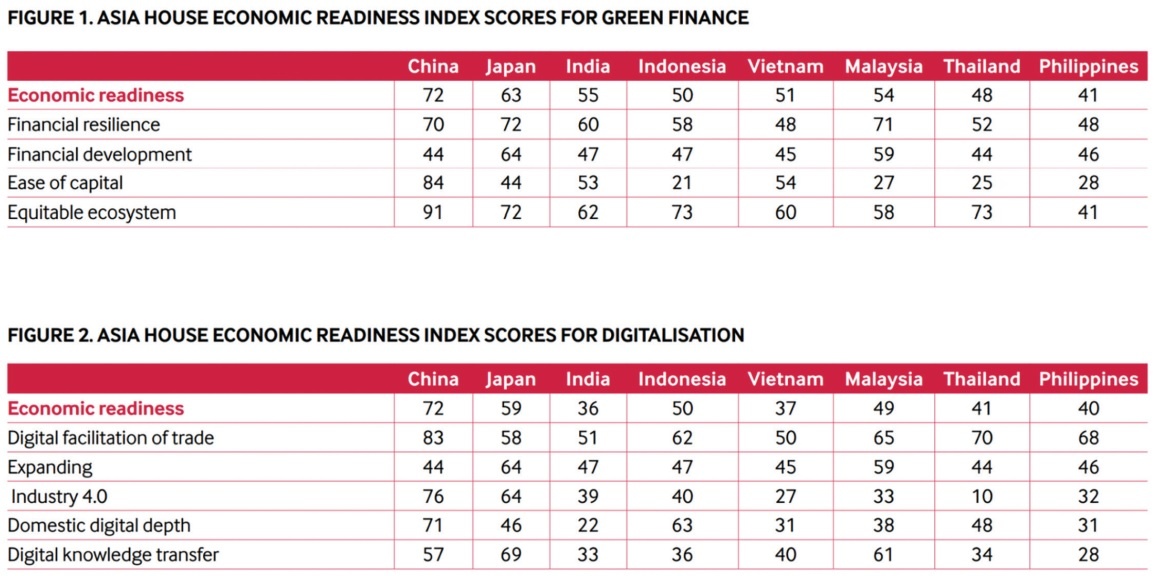

| Asian countries might be held back from sustainable and fair development in the middle-income trap, unless policy action is made to galvanize green financing, says London-based think tank Asia House. The group has examined eight important Asian economies, including Vietnam, using two new measures of progress in two key areas – green financial inclusion and digitalisation readiness. China’s economic growth would decrease in 2022 owing to the continuous interruption of COVID-19, according to the Asia House Economic Readiness Indices. In terms of digital preparedness, India is the least prepared of the eight countries evaluated even though its economy is predicted to expand the quickest this year. In order for the country’s long-term success, it must close its digital gap. While the analysis predicts that Japan’s economy will develop moderately in 2022, it also says that the country’s government must speed up digitalisation initiatives. Malaysia and Indonesia lead the way in Southeast Asia when it comes to green finance preparedness and digital transformation. Vietnam, on the other hand, scored 51 points in the “economic preparedness for green financing” and 37 points in the “economic preparation for digitalisation” indices. Source: Asia House |

|

| Pham Xuan Hoe - Former deputy director Banking Strategy Institute under the State Bank of Vietnam

The State Bank of Vietnam (SBV) and relevant ministries have made encouraging measures in the progressive greening of the financial sector in recent years. For instance, Decision No.1604/QD-NHNN from 2018 approving the scheme for green banking growth in Vietnam was made to implement the Green Banking Development Project, and 2015’s Directive No.03/CT-NHNN promotes green credit growth and managing environmental and social risks in credit extension. The SBV can thoroughly assess green loan portfolios of credit institutions and run stress-test models to evaluate climate change implications on banks’ operations. Another recent milestone was a new circular on environmental risk management in the loaning activity by credit institutions, which has just been finalised. The Ministry of Finance has also formulated various criteria for green bond issuance, which are based on a benchmark of green bond standards applicable to all ASEAN nations. These endeavours are fundamental premises for a prospective green monetary policy in Vietnam. The SBV must conduct research and present a proposal to the government to establish a green refinancing fund with low interest rates, which will be utilised to support lending initiatives and fulfil the government’s net-zero carbon emission pledge by 2050. | |

| Michele Wee - CEO, Standard Chartered Vietnam

The Vietnamese economy is now on a recovery trajectory this year, and we are living with the pandemic as it stands. In our own market research, our clients have told us that Vietnam holds tremendous future potential for growth and attraction of foreign direct investment. The country is also playing an increasingly important role in international trade and global supply chains, in addition Standard Chartered Vietnam is proud to support the developments of global supply chains and the growth of the small- and medium-sized enterprise market locally. We remain fully committed to Vietnam’s strong recovery and growth in 2022 and the years to come. The pandemic has highlighted the need for sustainable development and it is encouraging that the government is committed to green growth. At our fringe event at COP26 in Glasgow last year, we were pleased to host Prime Minister Pham Minh Chinh, along with cabinet ministers and global businesses. At the event, the prime minister made it very clear that Vietnam is committed to tackling climate change and pursuing a sustainable development strategy and to be a net-zero economy by 2050. As an institution, we have also committed to net-zero as an organisation and our balance sheet by 2050. This means that we will work with our clients and their supply chain as they progress their journey in this area. Vietnam can therefore count on us to fully leverage our international experience and Standard Chartered network to support the national agenda. As one of the oldest international banks in Vietnam with an 118-year history, Standard Chartered Bank remains fully committed to Vietnam as well as to our clients and stakeholders here. We look forward to continued support and do hope to be able to work on plenty of other similar activities in building a sustainable Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version