E-commerce logistics carries on remarkable growth

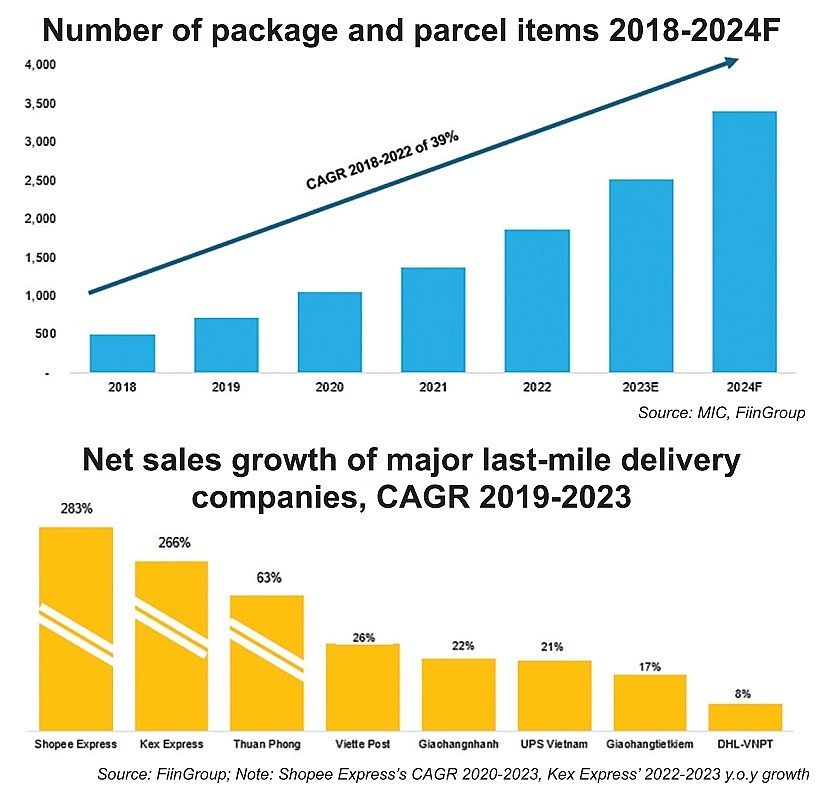

This surge highlights the increasing demand for efficient logistic services in the country, driving remarkable growth across the industry. New entrants such as SPX Express and Kex Express are expanding rapidly, with SPX Express leading the market with an impressive 283 per cent compound annual growth rate from 2020 to 2023.

|

| Anh Nguyen, manager of Market Research and Consulting, FiinGroup Vietnam |

Additionally, traditional players like Thuan Phong and Viettel Post have maintained their growth momentum, experiencing robust double-digit growth as they capitalise on market opportunities.

Given the promising outlook, Vietnam’s last-mile delivery sector has attracted a diverse array of players, including state-owned enterprises like Viettel Post and VNPost, private companies such as Giao Hang Nhanh and Giao Hang Tiet Kiem, and foreign-owned firms like Kex Express and Nin Sing Logistics, as well as e-commerce companies looking to penetrate the market.

Each group is implementing tailored strategies to capitalise on the immense market potential, driven by the growing demand for fast and reliable delivery services. As the sector expands, these companies are prioritising efficiency, innovation, and customer satisfaction to strengthen their competitive advantage.

In recent years, e-commerce platforms have also developed their own logistic subsidiaries to remain competitive in both service quality and operational efficiency. For example, and Lazada launched Lazada Express. With over 70 per cent of e-commerce orders originating from urban customers, they have strategically positioned modern warehouses near major metropolitan areas like Bac Ninh and Binh Duong provinces.

|

Additionally, these platforms are leveraging their global presence and networks to capitalise on the growth of cross-border e-commerce services, which is projected to grow at an annual rate of 28 per cent between 2022 and 2027, according to Amazon.

To boost competitiveness and quickly gain market share, all players in the last-mile delivery sector are actively working to enhance their operational efficiency by reducing lead times and damage rates through technological upgrades. They are concentrating on several key investment trends, including AI adoption, lead time optimisation, and the integration of robotics and automation technologies.

Viettel Post’s app, My Viettel Post, provides real-time package tracking, enabling customers to monitor deliveries, provide feedback, and rate services, further improving operational transparency and customer engagement. Similarly, Ninja Van leverages big data and real-time tracking systems to improve delivery visibility, enhancing the overall customer experience.

Effective communication, real-time tracking, and integrated systems between e-commerce platforms and delivery providers have become essential for maintaining an edge in this dynamic market. Notable partnerships include Ninja Van with Shopee, Viettel Post with Tiki, VNPost with Lazada, and J&T Express with TikTok Shop.

Viettel Post, for instance, has invested in state-of-the-art sorting facilities equipped with AGV robots and advanced cross-belt sorters, enabling the processing of up to 1.4 million packages daily. This automation reduces reliance on manual labour, lowers operational costs, and enhances efficiency – a trend that other logistics firms are likely to adopt, to strengthen their competitive edge.

Vietnam’s last-mile delivery sector offers significant market potential, fuelled by the rapid growth of e-commerce and evolving consumer demands for fast and reliable services. However, the market is changing quickly, particularly in technology, requiring players to stay informed about trends and market movements.

As competition intensifies, companies are investing in advanced technologies such as AI, automation, and integrated systems to enhance operational efficiency and reduce lead times. Those that prioritise innovation and adaptability will be well-positioned to seize the opportunities ahead, shaping the future of last-mile delivery in the country.

| Navigating turbulence in logistics and supply chains In 2024, Vietnam’s logistics and supply chain sector showcased remarkable resilience amidst an array of challenges, painting a complex picture of recovery, adaptation, and potential growth. Despite the hurdles, the sector has maintained a trajectory that promises gradual improvement, though not without facing significant setbacks that test its stability and future prospects. |

| Alignment with EU can address logistics issues Despite the growth in trade turnover so far this year, import and export activities between Vietnam and the EU continue to face unpredictability, a fragile recovery of consumer demand, and knock-on effects of geopolitical strife. |

| Logistics promise for foreign investors Vietnam’s logistics industry has become one of the fastest-growing sectors in the world, experiencing an annual growth rate of 14-16 per cent in recent years. Thomas Zagler, partner in Vietnam for Asian Insiders, shares his analysis on what foreign investors seek in this field and offers recommendations for enhancing investment into logistics. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

- Haiphong welcomes long-term Euro investment (February 16, 2026 | 11:31)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- Norfund invests $4 million in Vietnam plastics recycling (February 11, 2026 | 11:51)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- SCIC general director meets with Oman Investment Authority (February 10, 2026 | 14:14)

- G42 and Vietnamese consortium to build national AI infrastructure (February 09, 2026 | 17:32)

Tag:

Tag:

Mobile Version

Mobile Version