Dong devaluation fears dampened secondary bond market in 2015

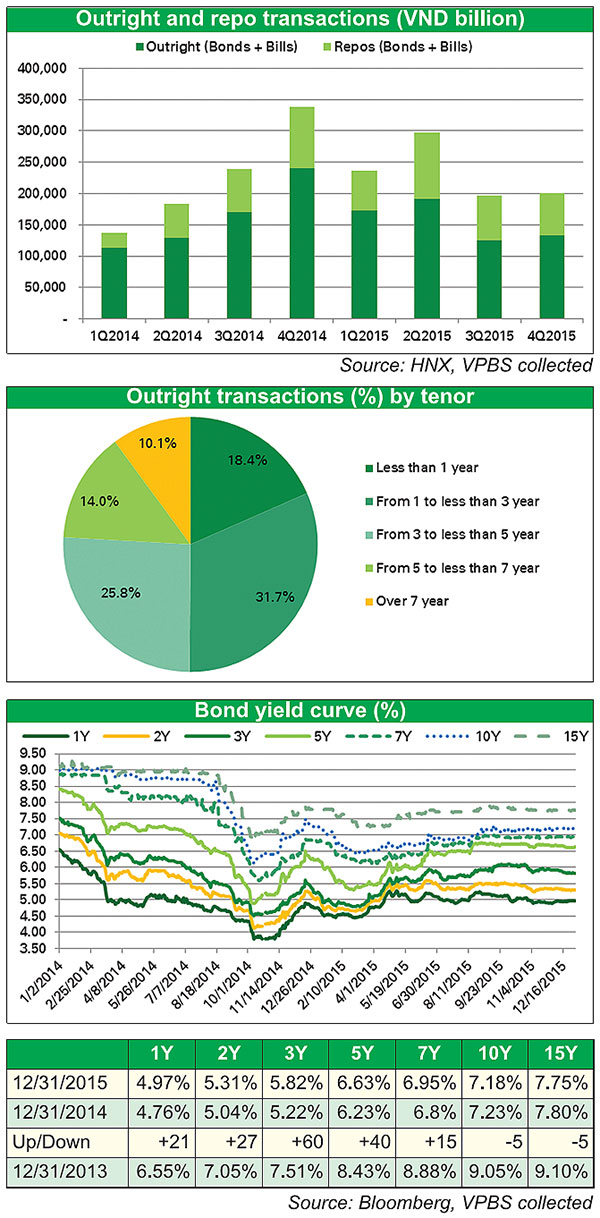

Although a high volume of bonds were issued in the primary market in the last quarter, which offered a large source of bonds for trading in the secondary market, trading volume increased by just 1.50 per cent compared with Q3/2015. Outright transactions continued to dominate the secondary market, contributing 67 per cent of the total transaction volume, equal to VND623,523 billion (USD28.5 billion). Meanwhile, repo transactions accounted for 33 per cent, equal to VND306,971 billion (USD14 billion).

Although a high volume of bonds were issued in the primary market in the last quarter, which offered a large source of bonds for trading in the secondary market, trading volume increased by just 1.50 per cent compared with Q3/2015. Outright transactions continued to dominate the secondary market, contributing 67 per cent of the total transaction volume, equal to VND623,523 billion (USD28.5 billion). Meanwhile, repo transactions accounted for 33 per cent, equal to VND306,971 billion (USD14 billion).

Domestic investors were not active in buying bonds in the secondary market during 2015 for several reasons. Firstly, substantial credit growth showed that commercial banks were diverting funds from bond investment to credit activities. Vietnam’s credit growth in 2015 reached 17.17 per cent – the fastest growth rate since 2011.

Secondly, bond investors preferred short-term bonds offering high liquidity and low risk, but these were not available in the primary market for most of the year due to a decision by the government. The supply of long-term bonds was therefore high, but demand was significantly lower, which caused low trading liquidity in the secondary market. In December, short-term bonds were offered again, with a significant supply in the primary market. However, participants in the primary market who were able to purchase short-term bonds did not sell them in the secondary market.

By tenor, the breakdown of outright transactions demonstrated that investors were focusing on short-term bonds with maturities of less than five years. During the year, trading of one-to-five-year bonds accounted for 75.9 per cent of total outrights, of which one-to-three-year bonds comprised the highest proportion. Over-five-year bonds contributed only 24 per cent of total outrights.

In 2015, foreign investors net sold some of Vietnam’s fixed income assets in the secondary market, notably in August (VND5,506 billion or USD251 million) and during the last quarter of 2015 (VND4,444 billion or (USD203 million). This was mainly due to increasing concerns over a devaluation of the dong, following the Chinese yuan devaluation and the Fed’s interest rate hike. Global investors sold off assets of emerging markets to return to the safety of the dollar and US assets with higher returns as a result of the US interest rate hike.

Overall in 2015, foreign investors net sold VND1,366 billion (USD62.3 million) of bonds and bills in the secondary market via outright and repo transactions.

Throughout the year, bond yields rose strongly at almost all tenors from the previous year, except for long-term bonds. As investors focused on trading short-term bonds while the supply source was limited, prices of these bonds decreased and market liquidity was low. Bond yields therefore rose sharply in the second and third quarters, but thereafter became stable for the remainder of the year as less-than-five-year bonds were again issued in the primary market. However, not many were offered in the secondary market, thus the liquidity of the market did not improve, and bond yields remained high.

In 2016, we expect bond yields to continue increasing, due to current pressures to issue bonds in order to support the state budget. There will likely be a large amount of bonds offered in 2016, with 30 per cent of these being less-than-five-year bonds, and 70 per cent more-than-five-year bonds. Although the supply will be large, demand seems to be low due to credit growth and a shortage of capital. The Central Bank expects credit growth to reach 18 to 20 per cent following substantial growth in 2015. Many banks will continue to engage in restructuring, resolving non-performing loans, selling bad debts to VAMC, and increasing provisions for bad debt.

Concerns over a dong devaluation in 2016 will also affect the demand for VND-denominated bonds from both local and foreign investors. Although the Central Bank has implemented a new mechanism to control the exchange rate, there is still the expectation that the Fed will continue raising interest rates in 2016, which would result in a rise in the value of the USD. Moreover, it is likely that foreign investors will continue to sell Vietnam’s fixed income assets, as Vietnam’s CDS significantly increased during the last quarter of 2015.

Nguyen Thi Ngoc Anh VP Bank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version