Digital banking, a motivation to develop a cashless society

The virtual conference themed "Digital Financing: Powering cashless economy" organised on June 22 and 23 by Star Media Group Malaysia was participated by top business leaders from across Asia in the field of finance, banking, information, and data management.

Event participants have shared their points of view and discussed the challenges and opportunities of forming and developing the cashless economy in the Asia-Pacific region.

The session in the morning of June 22 featured outstanding speakers such as Adrian Lee, head of Financial Services at KPMG Malaysia, Mohd Muazzam Mohamed, CEO of Bank Islam Malaysia Bhd., Dawn Lai, CEO of Experian Information Services Malaysia, and a representative from Vietnam, Henry Nguyen, CEO of Timo Digital Bank.

At this session, the speakers assessed the market on two topics: developing a cashless society and the potential of digital banking in the future.

|

| The "Digital Financing: Powering Cashless Economy" virtual conference was organised on June 22 by Star Media Group Malaysia |

Cashless society – an inevitable trend

At the virtual conference, the speakers all shared the opinion that a cashless society is a natural and inevitable development trend and the COVID-19 pandemic is a "hit" to make this process faster and more energetic.

Recently, the Central Bank of Malaysia has introduced new regulations to allow the application of digitalisation in the financial services sector and promote online transactions. Accordingly, digital banks will be officially licensed to operate, creating favourable conditions for forming five new digital banks in this country. In addition, the Malaysian government has announced plans to implement online payments for all public service payments next year to promote the future development of a cashless society in this country.

To achieve their macro goals, financial, banking, and technological institutions need to seize this moment to encourage and educate all sectors in the market about the benefits of cashless payments and promote synchronous development from many sides.

|

| Henry Nguyen, CEO of Timo Digital Bank |

Participating in the virtual conferenceas the first digital bank in Vietnam, Henry Nguyen, CEO of Timo Digital Bank, said that to apply the lessons of building a cashless society from successful countries like China into emerging markets including Malaysia and Vietnam, banks must strongly invest in their banking system and technology platform in an aim to keep up with the fast development of the world.

“However, I think the development of a cashless society will depend largely on the habits, behaviours, mindset, and the needs of customers, rather than just simply from banks. Besides providing perfect and up-to-date financial products and services, banks also have to profoundly understand the market, customers' needs and expectations. More importantly, banks must know how to identify problems and challenges that customers are facing every day in every transaction. From there, banks can offer products that bring the best solutions to make their life more convenient,” said Henry.

The most significant barrier for digital banks is building trust from customers.

After six years of establishment and development, Timo is appreciated as the pioneer and best digital bank in Vietnam. It also was recognised one of the effective digital banks in Asia.

“Digital banking has brought a completely fresh experience to make it easy for customers to open an account in just some minutes, manage their finances through a mobile app, and get loans easily and quickly. Besides, it also creates a new method of payment and transaction at the bank,” said Henry.

Henry, however, added that significant barriers that digital banks face in this period could be mentioned as legal regulations, risk management, capital ensuring, system upgrades, and many others.

“But above all, the big barrier for digital banking is how to build trust from customers, from which they confidently choose to use digital bank’s products and services,” he added.

|

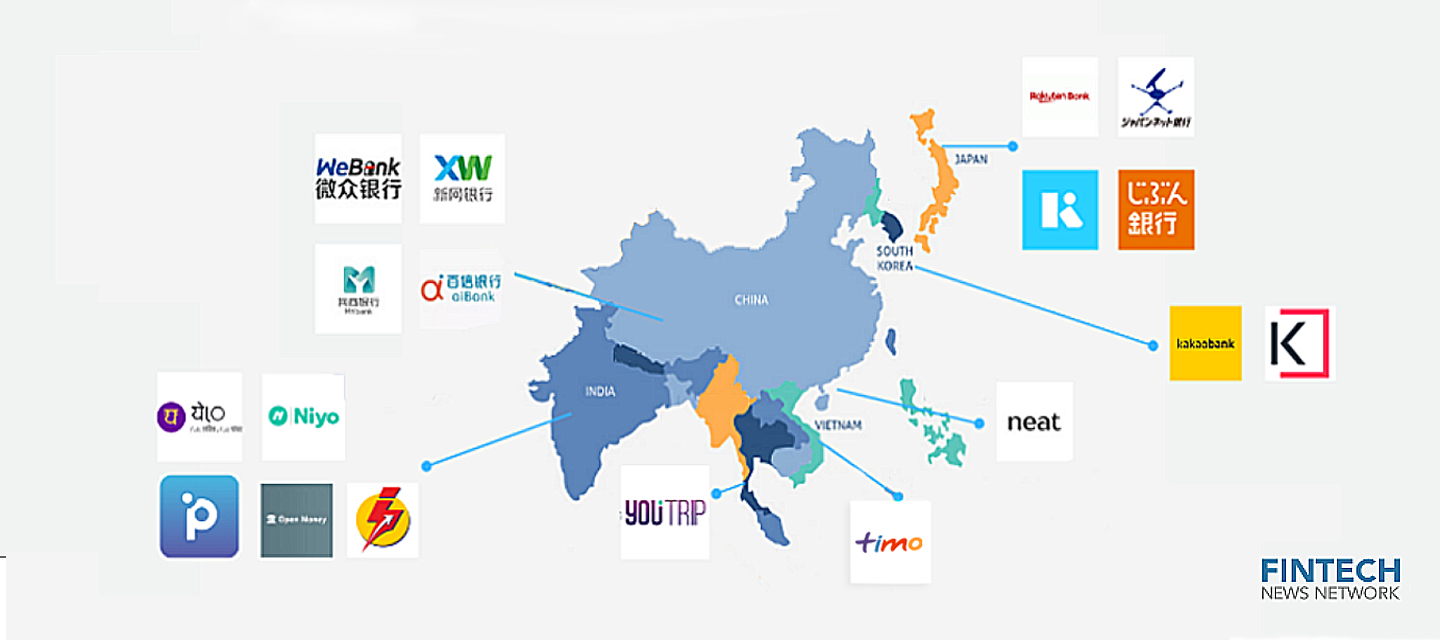

| Timo Vietnam is considered one of the effective digital banks in Asia.Source: fintechnews.sg |

According to a report released by Boston Consulting Group, digital banking is marking an outstanding development era in Southeast Asia. Since 2015, the number of digital banks has increased by 190 per cent. This fast speed was partly thanks to the encouragement from the government and management bodies.

Currently, traditional banks are also gradually adopting digitisation processes, besides the development of financial applications and e-wallets, among others, are all making the market more crowded and competition fierce. At the positive side, however, tough competition creates a driving force for the whole industry to develop together and build a cashless society in Asian countries.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version