Crisis of Rang Dong may not give Dien Quang new lease on life

|

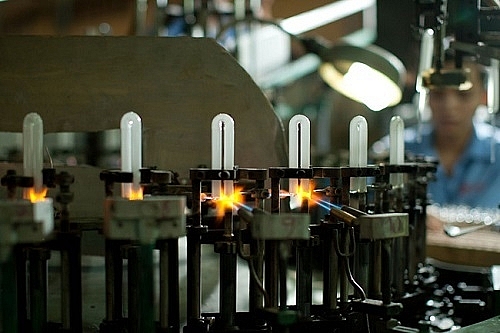

| Rang Dong suffered immense damage in the fire last week, but it may not be enough to get Dien Quang out of trouble |

While RAL fell from VND88,000 ($3.8) to VND77,500 ($3.37) during the weekend, DQC rose nearly 7 per cent.

“The fire not only caused Rang Dong VND150 billion ($6.52 million) in damages, but also blew off many investors’ expectations,” said Le Hang, investment consultant partner at a security company in Hanoi. “Rang Dong slipped, it is understandable that Dien Quang is in the limelight.”

However, Dien Quang's weak performance over the past two years makes a potential revival a far prospect. Since late 2016, securities companies have been gloomy about the bulb company's prospects. Accordingly, despite the growth in revenue, which remains above hundreds of millions of US dollars per annum, its profit has been falling since 2014.

In 2018, Dien Quang’s pre-tax profit was more than VND110 billion ($4.78 million), down nearly 65 per cent against the peak in 2014. The gross margin also dropped from 35 to 20 per cent due to its inability to liquidate stockpiles at a low price.

As a result, Dien Quang lost the crown to Rang Dong in the local stock market. Before 2014, the company’s capitalisation was about twice as much as Rang Dong's thanks to their higher scale of the market capitalisation. However, the tables have turned since then. Specifically, Dien Quang’s capitalisation was only half of Rang Dong's in 2016. The RAL stock closed the latest trading session four times higher than DQC.

Dien Quang's exports have also been finding it difficult to compete with Chinese companies, which offer LED products at a more reasonable price. To add salt to injury, the General Department of Tax in April issued the decision to collect nearly VND38 billion ($1.65 million) in tax from the company, equalling 63 per cent of its expected pre-tax profit in 2019.

In the face of these mounting difficulties, Rang Dong having its legs swept from under it may not be enough to put Dien Quang back on track.

On the other hand, Rang Dong's performance is unpredictable, according to information published at its 2019 shareholders' meeting. In 2015, its key products contributed 69 per cent of ts total revenue, which by 2018 fell to 16.6 per cent. “Rang Dong targeted achieving a profit growth of 25.6 per cent in 2018, but only reached 21.1 per cent – a sign of tough operations in years ahead,” said Nguyen Doan Thang, chairman of Rang Dong.

The recent fire has put Rang Dong into a corner. The company estimated that the damage is equal to VND150 billion ($6.52 million), but analysts speculate it could be even higher than that. As of the end of the second quarter of 2019, its total debts accounted for nearly 70 per cent of its total capital. Relating to its first-half performance, Rang Dong’s revenue was four times as much as Dien Quang, but their gross margins were similar.

This shows that Rang Dong has been using huge loans to improve its operations and has been running lower profit margins to increase its market share. Specifically, its interest expenses and sales costs were ten and six times as much as Dien Quang's.

While this strategy has helped Rang Dong get ahead of Dien Quang in recent years, it is a double-edged sword that can have severe repercussions if the company runs into trouble.

The RAL stock's recent fall made investors concerned about the company's prospects. “RAL’s market price shrank by 12 per cent in only two sessions, everybody is worried,” said Hang from a security company in Hanoi.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

Mobile Version

Mobile Version