A reshuffled deck key to winning hand

Vietnam’s banking sector assets have seen strong growth during recent years, climbing to VND2,690 trillion ($130 billion) in 2010, a sharp increase of 33.92 per cent on 2009 numbers and twice the 2007 figure.

This figure is forecasted to reach VND3,667 trillion ($177 billion) by the end of 2012.

In the long-term, PricewaterhouseCoopers forecast the total assets of the sector will achieve an average growth rate of 9.3 per cent during 2009-2050, which is much higher than that of Asian countries like Indonesia, China and the same as that to be experienced by India. This fast growth indicates good prospects for the sector but a higher quality of asset management is needed to achieve an equivalent growth of profitability.

The increase in households’ income and demands for retail banking also enabled the sector to generate a high growth rate of 29.5 per cent in the number of banks from 2006 to 2010. There were 101 banks and foreign bank branches operating in 2010. Accordingly, the number of ATMs rocketed from 1,800 in 2005 to 11,700 in 2010 while the number of credit and debit cards issued doubled to 31.7 million during 2008 - 2010.

Competition boils over

Vietnam’s banking sector includes three groups of banks: state-owned commercial banks (SOCBs), joint stock commercial banks (JSCBs) and joint venture banks and 100 per cent foreign-owned banks (JVBs and FBs).

Most SOCBs have the advantage of large capital size, reflected in the VND64,037 billion ($3.1 billion) in chartered capital of the four largest SOCBs in 2010. Their traditional customers are state-owned enterprises (SOEs), which have higher exposure to non-performing loans (NPLs) than other enterprises. According to State Bank statistics, 60 per cent of 2010’s NPLs were those of SOEs.

Meanwhile, JSCBs have a more diversified shareholder composition than SOCBs and focus on retail banking and lending to small- and medium-sized enterprises (SMEs). However, most of these banks have small chartered capital size – below VND5,000 billion ($242 million). As a result, many banks have faced liquidity problems and this ignited an interest rate among banks in the first half of 2011. These problems have become even more severe given the 14 per cent credit cap is being strictly implemented by the State Bank. This has led to VND deposits shifting from small to large banks. Some banks are also under pressure to meet the minimum requirement of VND3,000 billion in chartered capital by the end of 2011.

Being supported by modern technology and good corporate governance, JVBs and FBs have advantages in developing sophisticated products and providing high quality services to customers. Large FBs like HSBC, Citibank, ANZ, Standard Chartered and Deutsche Bank took major steps in expanding their operating network in Vietnam in late 2010. Citibank and Standard Chartered officially launched its retail banking in Hanoi in October 2010 while HSBC increased its number of branches from three to five in September last year. Many other foreign bank branches (FBBs) including Huanan, Chinatrust and Mizuho also increased the capital contributed by their parent banks at the end of 2010. In addition, some FBs are holding stakes in domestic JSCBs to exploit their customer base and operating network.

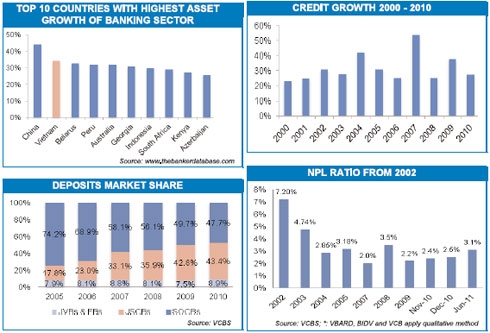

The competition among these three groups in lending and mobilising funds has become significantly more fierce. In detail, the market share of JSCBs grew dramatically in recent years, reaching 37.1 per cent for credit and 42.8 per cent for deposits in 2010. These banks did this by successfully grabbing market share from SOCBs. However, the market share of JVBs and FBs, particularly in terms of deposit shares, has not undergone any major changes due to their mobilisation being capped in relation to capital sourced from parent banks. The deposit and credit market share of these banks were 8.9 per cent and 13.6 per cent respectively in 2010. Although the limits on fund mobilisation have been lifted since the beginning of 2011, it will take FBs some time to boost their market share in their favour as their operating networks are relatively small compared to those of domestic banks.

But in terms of retail banking, FBs have put increasing pressure on SOCBs and JSCBs with the advantage of technology creating a firm base for them to provide sophisticated products and enhance their retail banking with higher profit margins. FBs are also likely to show strong expansion in future as they are now on an equal footing with domestic banks. Although their deposit and credit share cannot soar immediately because of modest operating networks, the lifting of limits on fund mobilisation has enabled them to expand their businesses and customer base. Leading banks in this group will be the ones who persist with Vietnam and have a firm understanding of the Vietnamese market. These include HSBC, ANZ and Standard Chartered.

Credit growth races ahead of GDP

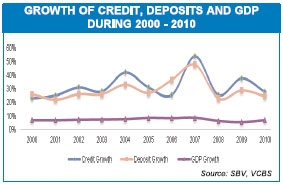

Vietnam’s banking sector has demonstrated typical characteristics of an emerging market in the fast growth of credit, deposits and money supply M2 during 2000-2010. The average growth of deposits and M2 were 28.91 per cent and 29.19 per cent respectively while that of credit reached 31.55 per cent. Compared with regional peers, Vietnam’s credit and M2 growth are much higher than those of Indonesia (14.5 per cent and 12.4 per cent) and Thailand (7 per cent and 4 per cent). Therefore, this growth has partially contributed to Vietnam’s high average GDP growth of 7.15 per cent in this period.

Some researchers have pointed out that credit growth ranging from 14 per cent to 20 per cent can generate a GDP growth of 7 per cent without causing a credit bubble. When this growth exceeds 20 per cent, however, the health of the economy may be threatened. Vietnam finds itself in this position with credit growth four times higher than GDP growth in 2010. This is one of the reasons why international rating institutions like Fitch, S&P and Moody’s downgraded Vietnam credit rating in 2010.

In response to this issue, the government promptly drew up the 2011-2015 plan with top priority given to credit activities. The government will focus on stabilising the purchasing power of the Vietnam dong and limiting credit growth to within three times that of GDP growth. At the same time, M2 growth will be maintained in accordance with economic growth with a preference for a low growth rate to control inflation.

Loaning up to the truth

Currently, there are two main concerns regarding loan quality: the significant increase in NPLs of the sector in recent times and the differences in loan classification between the Vietnam Accounting Standard (VAS) and the International Accounting Standard (IAS).

Recent State Bank statistics show an upward trend in Vietnam’s NPL ratio from 2007 to June 2011, excluding the figure for 2008 when the financial crisis occurred. By the end of June 2011, the NPL ratio of the whole sector was 3.1 per cent, 60 points higher than in 2010 with group 5 loans accounting for 47 per cent of total NPLs. In particular, the NPL ratio of Ho Chi Minh City was as high as 4.39 per cent. According to State Bank representatives, the worst case scenario would see NPL ratios reaching 5 per cent by the end of 2011, which is much higher than the 3.5 per cent of 2008 and the highest level since 2003. Persistent high credit growth together with inefficient credit management and low transparency are the main reasons for this increase.

Therefore, the State Bank has showed its determination to improve credit management by introducing the 2010 Credit Law, which focuses on strengthening the management of credit institutions to bring them closer to international standards. In terms of transparency, Circular No.09 regulating public disclosure is being sent for feedback. This document will help improve the transparency of firms and banks.

It is noteworthy that the NPL ratio of 3.1 per cent was calculated based on VAS while that figure was actually 13 per cent according to IAS. The huge gap was caused by the differences in loan classification between these two accounting systems. At present, Vietnamese banks only classify the due amounts of NPLs that cannot be paid and not the whole outstanding loan. Using the IAS system, however, the whole loan amount is the basis for calculations. In addition, the current practice of most domestic banks is to use quantitative methods to classify their loans without considering qualitative factors like financial status and business results of enterprises, resulting in an inaccurate reflection of loan quality.

Both quantitative and qualitative methods were introduced five years ago in Decision No.493/2005/QD-NHNN. To date, however, only BIDV, Agribank and VCB have applied both these methods. There are three main explanations for this. Firstly, banks have to build their own internal credit rating system to apply the qualitative method, which is not a simple task. Second, Decision 493 did not provide detailed instructions on applying the qualitative method.

And most importantly, classifying loans under the new method causes the NPL ratio to be three times higher than using the traditional scheme and very few banks want to reveal such a high NPL figure. That also explains why some banks use loan rescheduling or avoid classifying their loans into group 3-5 to as a way to maintain a low NPL ratio. As a result, the gap in loan classification between VAS and IAS is getting bigger.

To tackle this problem, the draft of new Circular on loan classification is being sent out for feedback. Decision No. 493 will then be replaced.

Banks undervalued

Vietnamese banks have managed to maintain good profit growth even in the economic downturn. This is reflected in the average growth of the top eight banks in 2008, 2009 and 2010 (46 per cent, 59 per cent and 31 per cent respectively). Banks notching up outstanding performances in this period were mainly JSCBs. These were EIB, MB, TCB and MSB. CTG is the only representative of SOCBs achieving outstanding performance during 2008- 2010. Although FBs’ business results were not widely published, leading player HSBC reported a high net profit after tax growth of 40 per cent in 2010.

The listed banks are trading at a price-to-earnings (P/E) ratio of 8.5x, which is not high in comparison to listed companies in sectors like food (12.9x), insurance (14.4x), real estate (11.5x), investment (10.8x) and tourism (9.2x). In addition, Vietnamese banking stocks with a P/E of 8.5x and a price-to-book ratio of 1.2x are undervalued compared to other countries like Malaysia, Indonesia, Thailand and the Philippines. Meanwhile, profitability is maintained at a high level of 1.4 per cent for return on assets and 16.6 per cent for return on equity.

All things considered, the current market conditions favour large banks with high financial capacity in terms of lending and mobilising funds. However, banks still need to further improve loan quality and maintain high but sustainable growth.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version