Wind survey snags concern developers

Of the nearly 100 registered offshore wind projects in Vietnam, boasting capacity of up to 156GW, just over half have applied to carry out wind surveys via the Ministry of Natural Resources and Environment. However, only two projects have been licensed to survey and measure wind, and the ministry has now suspended the granting of new permits due to legal and technical problems.

Nguyen Thi Thanh Binh, deputy general director of T&T Group, admitted the process of survey licensing, project approval, and investor selection for offshore wind projects may be prolonged.

“This situation makes it difficult to for the country to achieve 7GW of offshore wind power by 2030 as stipulated in the draft Power Development Plan VIII (PDP8),” Binh said.

“Currently, the work of applying for field surveys and wind measurements is being suspended pending the amendment of Decree No.11/2021/ND-CP stipulating the allocation of certain marine areas to organisations and individuals to exploit and use marine resources,” Binh confirmed.

Non-profit organisations and associations including the Global Wind Energy Council (GWEC) suggested that the government should have a transitional mechanism in place so that some ready-for-approval applications could be processed using the current mechanism.

In addition, GWEC strongly advised that certain technical and financial criteria be used when the government chooses developers to issue site survey licences in order to guarantee that projects can be completed on schedule.

|

Many basic principles in the process of developing the PDP8 have been set out and remain unchanged through numerous submissions. These include promoting the development of renewable energy sources with reasonable prices associated with ensuring operation safety and general economy of the power system, and giving priority to the development of renewable energy sources for local consumption or export.

The plan also wants to encourage the development of rooftop solar power and solar power at production and business establishments in the form of self-production and self-consumption, without generating electricity on the national grid.

The rising demand for electricity and the abundant potential of offshore wind power sources have been deemed a great motivation to promote the development of offshore wind power in Vietnam – however, most projects still appear on paper only.

An industry insider said, “In fact, there are urgent projects that are standing still because they are not included in the revised PDP8, which has not yet been approved.”

He added that the delays are worrying investors who want to pump money into solar, wind, or liquefied natural gas power ventures.

Offshore wind projects in particular usually aim for a large capacity of 2-5GW and are typically phased in accordance with absorbing and transmitting capacity. The first phase can involve proposals to develop an average capacity of about 1GW.

Stuart Livesey, CEO of the La Gan offshore wind project in the south-central province of Binh

Thuan, said policymakers must take immediate action to clear the way for the industry to grow. “A proactive offshore wind strategy would also give Vietnam a competitive edge in the region because it would establish the country as a leader in Southeast Asia for this clean energy technology,” he explained.

Livesey recommended that the government create an atmosphere more favourable to investment and a legislative structure that chooses and promotes seasoned foreign developers to influence the market.

“It would be unrealistic for Vietnam to enter the offshore wind industry after only 20-30 years, thus we suggest transitional mechanisms set up with a number of pilot projects, which would give Vietnam time to learn,” he added.

Having been asked how Ørsted partners effectively with the Vietnamese private sector and government to help the country leverage and address energy transition challenges, country manager Sebastian Hald Buhl said that several levers need to be activated between the public and private sectors in offshore wind that demands an average investment of $3 billion dollars and an eight-year payback period.

“For such projects, we are analysing whether or not projects can be completed on time and within the estimated budget. The key factor that helps during this process is regulation,” Buhl said. “A regulatory framework will give the incentive to develop and implement these projects at the right cost without cutting back on financial returns.”

Another lever identified is to partner with local Vietnamese companies to bridge the technology and knowledge gap and bring along local actors on this journey.

“Companies expect clear information about the power development plan and the plan concerning the implementation policies. The legal and policy framework needs to be developed quickly to allow private investments in the national energy industry,” Buhl added.

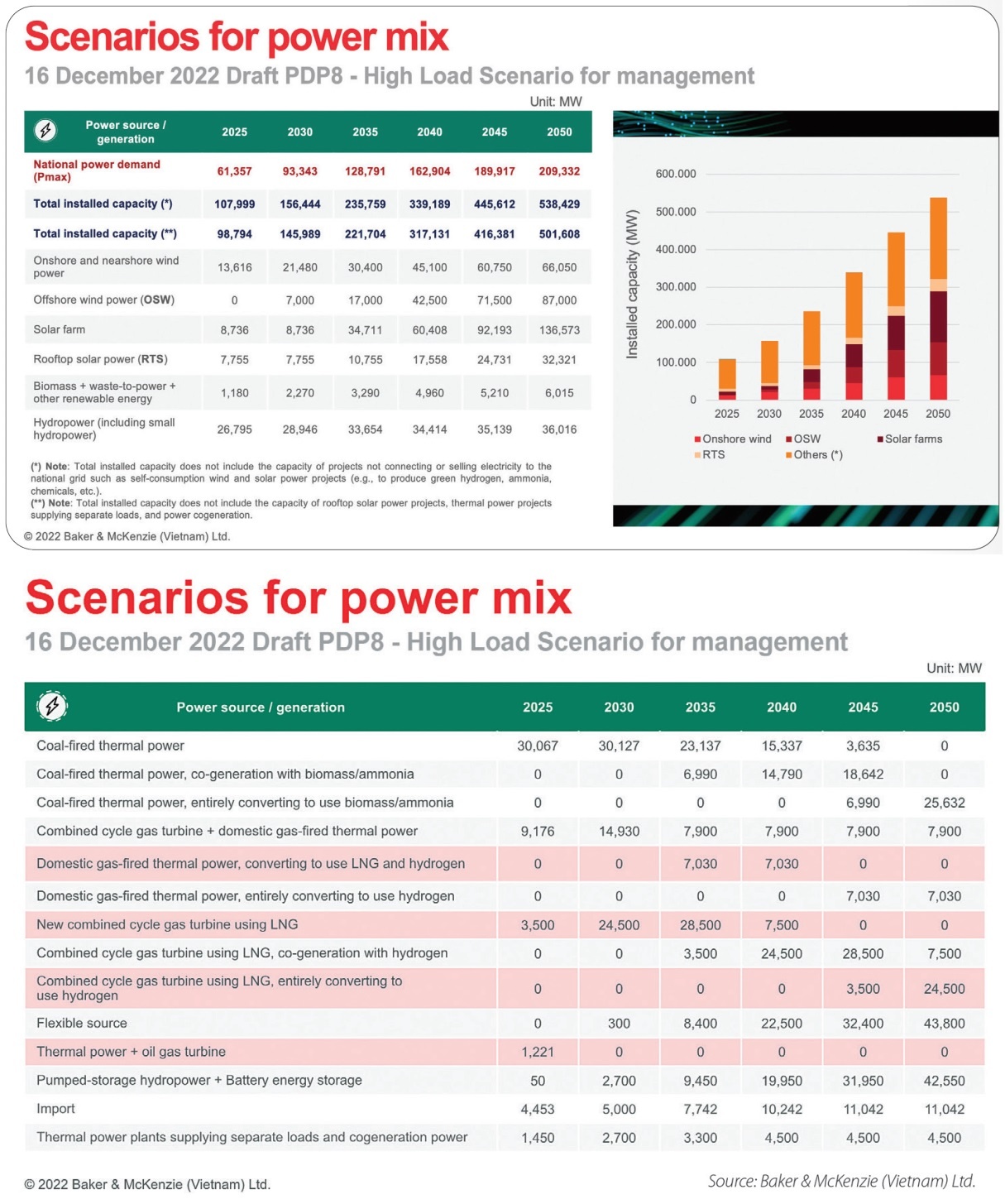

In its latest white book, the European Chamber of Commerce in Vietnam noted that the latest PDP draft has raised many concerns and questions. “As released in the last draft, the high-low operation scenario shows onshore energy increasing statically from now until 2050. Solar farms will remain the same until 2030 and then will increase significantly until 2050. Offshore wind will also play an essential role from now until 2050,” it noted.

Binh of T&T Group advocated for several aspects to be clarified in the framework, such as the mechanisms to select investors for renewable energy projects, tariff mechanisms, and the electricity sales model.

“Other countries have had decades of development and now boast synchronous infrastructure, increasing localisation rate, quality human resources, and especially a clear system of mechanisms and policies,” said Binh.

| Assessing the dual features of nation’s energy plan and PDP8 Vietnam’s immediate prime concern is to conclude its energy plans and establish a blueprint for sustainable growth. The Vietnam Academy of Science and Technology’s Dr. Bui Huy Phung, a former member of the Power Development Plan VII (PDP7) Appraisal Council, responded to VIR’s Hai Van on this topic. |

| Ensuring the new PDP meets power source criteria The Ministry of Industry and Trade was allotted 10 years to reinterpret solar data in the Power Development Plan VIII, yet delays continue to plague it. Van Nguyen of VIR sat down with Dr. Ngo Duc Lam, former deputy director of the Institute of Energy, about the current situation. |

| Solar data scrutiny the latest pain point for PDP progress The country’s Power Development Plan VIII is now roughly three years behind schedule and way off the prime minister’s demand that “preparation must be one step ahead” because of disparities in solar power statistics. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

- Bac Ai hydropower works stay on track despite holiday period (January 16, 2026 | 16:19)

- Fugro extends MoU with PTSC G&S to support offshore wind growth (January 14, 2026 | 15:59)

- Pacifico Energy starts commercial operations at Sunpro Wind Farm in Mekong Delta (January 12, 2026 | 14:01)

- Honda launches electric two-wheeler, expands charging infrastructure (January 12, 2026 | 14:00)

Mobile Version

Mobile Version