WB: Vietnam’s mid-term economic prospects remain positive

|

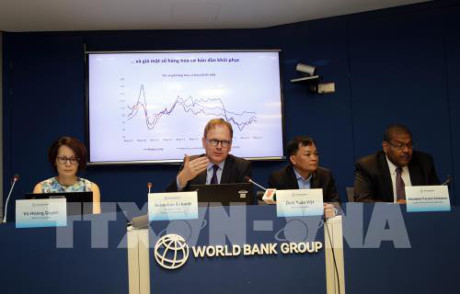

| Acting Country Director for the World Bank in Vietnam, Sebastian Eckardt |

He said Vietnam’s GDP is projected at 6.3% this year and 6.4% in the 2018-2019 period.

“Vietnam’s economy is strong, as a result of strong momentum of Vietnam’s fundamental growth drivers - domestic demand and export-oriented manufacturing.”, said Sebastian Eckardt, Lead Economist and Acting Country Director for the World Bank in Vietnam. “These are good conditions to address critical structural bottlenecks to medium term growth while solidifying macroeconomic stability and rebuilding policy buffers.”

The World Bank’s latest report on the Vietnamese economy upheld Vietnam’s fundamental driving forces for growth, including domestic demand and the manufacturing industry.

The WB Acting Director said Vietnam should be more prudent in macro economic governance while the budget deficit should be contained given more risks in budget stability. Vietnam still faces long-term challenges of maintaining a high growth rate and achieving sustainable poverty reduction.

According to the WB report, the service sector-which accounts for about 42 percent of GDP- accelerated in the first half of this year, driven by buoyant retail trade growth, as a result of sustained growth of domestic consumption. Industrial production remains robust despite a significant reduction of output in the oil sector, and growth has gradually recovered in agriculture, though the recovery is still fragile.

Monetary policy continues to balance growth and stability objectives, with low real interest rates and rapid credit growth of about 20% (year-on-year). The rising credit intensity of growth, and sustained acceleration of credit may raise concerns over asset quality, particularly given the past unsolved bad debts.

The report notes that after a large surplus in 2016, Vietnam’s external current account balance started to decline in early 2017, due to an expected recovery in import growth.

The nominal exchange rate has been relatively stable, but the real exchange rate continues to appreciate. Real exchange rate appreciation is driven by a large external surplus of the FDI sector, but is a concern for Vietnam’s domestic private enterprises, which continue to face significant competitiveness challenges.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- E-commerce race heats up with new player entering arena (December 19, 2024 | 16:03)

- Interest must rise for carbon exchange (December 19, 2024 | 16:00)

- Limitations abound for domestic EV carbon credits (December 19, 2024 | 15:00)

- Businesses pivotal in offsetting carbon measures in Vietnam (December 19, 2024 | 13:00)

- Coordination key for circular economy (December 19, 2024 | 10:56)

- Vietnam’s first logistics laboratory established (December 19, 2024 | 08:00)

- Masan Consumer Holdings honoured with consecutive "Great Place To Work" certifications (December 18, 2024 | 16:55)

- SABECO’s research facility a dream for its brewmasters (December 17, 2024 | 10:30)

- Digital twins reshaping Vietnam's logistics and supply chain landscape (December 17, 2024 | 09:34)

- Enterprises awarded for pioneering innovation to attract talent (December 16, 2024 | 16:43)

Mobile Version

Mobile Version