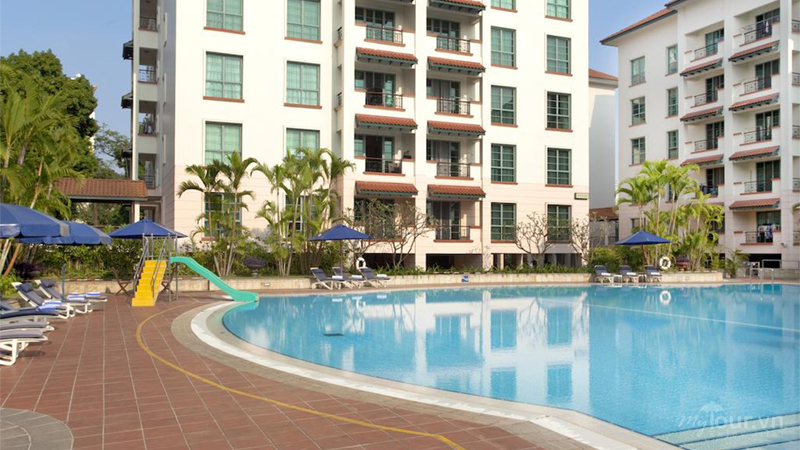

Hanoi serviced apartment market poised for expansion in next two years

|

According to CBRE’s report on the Hanoi real estate market for the second quarter of 2016 released on June 28, the supply of serviced apartments is anticipated to reach nearly 4,000 units by 2018, with prominent projects such as Somerset West Point, Somerset West Central, and Trang An complex. All of these are high-end serviced apartment projects located in office-clustered districts of the city.

Even though the segment has seen little change in terms of tenancy rates, which has been stable at between 70 and 80 per cent, there should be little worry about whether the new developments will be filled.

According to managing director of CBRE Vietnam Marc Townsend, the demand is set to increase soon as the economy grows.

“I think as the economy grows and moves towards information technology, it will bring in a lot of consultants. So, groups like CapitaLand, Mapletree, and Frasers are looking at their offering and they have decided to invest more in serviced apartments in Hanoi and Ho Chi Minh City,” he said, adding that foreigners soon coming to Vietnam were mainly Asian and serviced apartments would be a good solution.

In April, Singaporean developer Keppel Land Ltd.’s subsidiary Palmsville Investment Pte Ltd., sold 70 per cent of its stake in Quang Ba Royal Park Joint Venture Company Ltd. to Vietnamese BRG Group Joint Stock Company for VND492 billion ($22 million). Quang Ba Royal Park is Palmsville’s joint venture with Hanoi Trade Union Tourism Co., Ltd. established to own and operate the first serviced apartment block in Hanoi, the 155-apartment and 20-villa Sedona Suites Hanoi in Tay Ho district.

The leaving of a foreign developer to let a Vietnamese one take over in this case does not mean that the market is no longer attractive, according to Townsend. Similar to the recent sales of assets by foreign developers to Vietnamese ones, the trend comes down to legality.

“One of the issues at play is the lease holding structure we have in Vietnam on some of these hotels, office towers, and serviced apartments. A lease can only be held for 20-30 years. Some of these projects are at 20-30 years already, so investors want to get out. Thus, we see Keppel selling some assets in Hanoi. Same with CapitaLand. They are selling good assets that they developed,” he said.

According to the report, the second quarter of 2016 recorded no new addition to the supply of serviced apartments for sale in Hanoi. The total supply remained stable at 3,239 units, with more than 30 per cent accounted for by two-bedroom units. Grade A serviced apartments took up to 71 per cent of the total supply, most of which were located in Tay Ho, Ba Dinh, and Tu Liem districts.

As of the end of the quarter, the average asking rent of Grade A and Grade B apartments were $31.7 and $21.7 per square metre per month (psm pm), respectively. The highest rent rates continued to be charged in Cau Giay district, at $36.3 psm pm in Grade A and at $28.9 psm pm in Grade B, followed by Ba Dinh and Tu Liem districts. There was a smaller deviation in the average price of grade A apartments by district than those of Grade B, indicating the heated competition among these projects.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- CapitaLand Development unveils Orchard Heights in Binh Duong (March 25, 2025 | 10:14)

- Danang kicks off construction of $460 million new urban area (March 24, 2025 | 14:49)

- Can Gio coastal tourism area to span 1,357 hectares (March 24, 2025 | 14:46)

- Hospitality sector heading towards new development cycle (March 21, 2025 | 17:48)

- PVI AM and SonKim Capital partner to develop luxury real estate investment (March 20, 2025 | 14:17)

- Social housing drive can lead to developer incentive (March 20, 2025 | 09:00)

- Industrial real estate remaining lucrative (March 19, 2025 | 16:04)

- Singaporean diplomat highlights green cooperation for sustainability (March 19, 2025 | 14:23)

- KCN Vietnam Group signs comprehensive partnership with VietinBank (March 16, 2025 | 14:00)

- Hanoi’s serviced apartment sector benefits from surging FDI (March 13, 2025 | 16:31)

Mobile Version

Mobile Version