Advanced search

Search Results: 1,372 results for keyword "KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun".

Instructions on extension or delay of tax payment by COVID-19

11-03-2020 10:21

In the case of suffering material damage due to natural disasters or epidemics such as COVID-19, businesses can apply for an extension in tax payment and even exemption from late payment fees.

MoIT to talk with the US on Minh Phu tax evasion case

10-02-2020 09:40

The Ministry of Industry and Trade (MoIT) has said it will talk with the US on the case of local Minh Phu seafood firm, which was accused of tax evasion in the US.

Hanoi Tax Department to scrutinise transfer pricing in 2020

18-01-2020 12:30

The Hanoi Tax Department will scrutinise transfer pricing among foreign-invested enterprises in 2020, announcing it as its key task for the year.

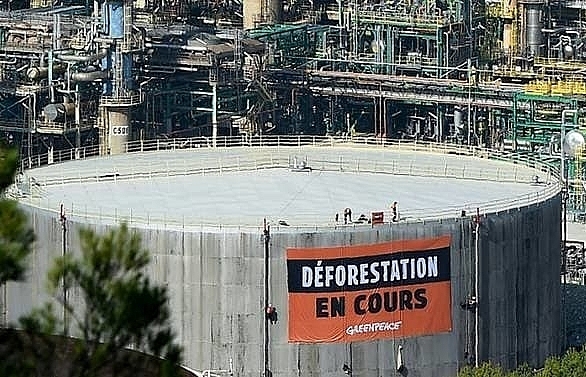

France reverse palm oil tax break after outcry

16-11-2019 09:32

France's parliament on Friday voted down a proposed tax break on palm oil - which would have hugely benefited energy giant Total - after lawmakers and environmental activists complained the legislation had been rushed through the day before without proper debate.

EY Vietnam: Enterprises should actively manage tax risk

17-09-2019 10:16

More than 400 representatives from different businesses in Vietnam participated in the 2019 Tax Symposium on “How to better accommodate an increasingly stringent tax administration system driven by digitalisation” organised by EY Vietnam and Vietnam CFO Club.

Google agrees €945 million tax settlement with France

13-09-2019 16:50

US internet giant Google has agreed a settlement totalling €945 million (US$1 billion) to end a tax dispute in France under an agreement announced in court on Thursday.

Gov’t gives green light for new corporate income tax proposal

25-07-2019 16:19

The Government has turned green light to the Ministry of Finance’s latest proposal on preferential corporate income tax rates for small and micro enterprises (SMEs).

Tax incentives to push foreign firms to recruit locally

10-11-2003 18:03

Foreign businesses will have more incentive to employ Vietnamese staff if a Ministry of Finance proposal to raise the monthly personal income tax threshold for Vietnamese employees to VND4 million ($258) gets the nod.

Google surprises world by talking for international tax framework

04-07-2019 07:37

After coming under fire across the globe for tax evasion, Google finally raised its voice about the issue. However, contrary to the forecasted objection, the tech giant’s representative said that it completely agrees that there is need for an international tax framework on multinational companies.

Tax payers have right to appeal audit decisions: NA deputies

25-05-2019 10:14

Tax payers can appeal the decisions of State audit agencies if they believe the decisions are illegal or harmful to their operation, National Assembly deputies said on Friday.

MoF cool on income tax law despite NA heat

20-02-2004 18:03

THE personal income tax law may not be developed until the end of 2006 at the earliest despite strong pressure from the National Assembly, the Ministry of Finance has announced.

Optimum tax strategy to cut costs and ensure compliance

30-04-2019 14:00

Optimising tax costs has been an increasing concern for firms in the private sector (*). Having a correct understanding from both the government and businesses will lead to positive actions and, as a result, help enterprises cut costs effectively while still growing business, in accordance with the advocacy and policies set by the Vietnamese government. VIR’s Hoang Anh talked with Bui Tuan Minh, tax partner of Deloitte Vietnam, on this important issue.

Ministry wants to reduce tax on locally made auto parts

20-02-2019 10:34

The Ministry of Finance has asked the Government to amend its laws to eliminate the special consumption tax on locally manufactured auto parts and components, a move which could reduce prices of locally assembled cars.

PM steps in to end Phu My Hung tax row

17-08-2004 18:03

A prolonged dispute concerning the corporate income tax level Phu My Hung joint venture is to pay on land and housing business activities has finally come to an end.

Macron government on tenterhooks as new tax regime takes effect

03-01-2019 08:49

PARIS: The French government sought on Wednesday (Jan 2) to downplay fears that workers will be left out of pocket as the country transitions to a pay-as-you-earn tax system that could fan the flames of a revolt over spending power.

Mobile Version

Mobile Version