Advanced search

Search Results: 1,371 results for keyword "KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun".

Tax authorities clamping down on foreign evaders

13-12-2019 11:53

Foreign-invested enterprises will no longer be allowed to ignore their tax obligations as Vietnamese tax departments step up action on duty-dodging businesses.

Most enterprises satisfied with tax administrative reform

20-11-2019 08:00

Seventy-eight per cent of surveyed enterprises expressed satisfaction with tax administrative reforms this year, up 3 per cent compared to 2016.

Crude import tax zeroed in November

20-09-2019 10:10

The Prime Minister announced import tax on crude oil will be scrapped from the current rate of 5 per cent.

Tax implications of cross-border trade

17-06-2019 08:57

"Decree 20 also gives the tax authorities the power to use internal databases for TP assessment purposes in the case of a taxpayer being deemed non-compliant with the requirements of the decree."

France sticks to digital tax despite US anger

05-04-2019 20:02

Finance Minister Bruno Le Maire said on Friday (Apr 5) that France would stick to plans for a tax on digital giants such as Facebook and Apple, despite displeasure in Washington.

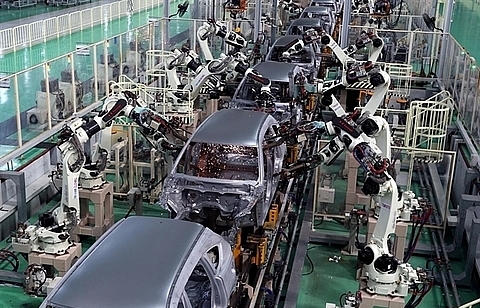

Car deals to cushion tax impact

12-04-2004 18:03

CAR firms are supporting registration fees and reducing prices to lure back customers scared off by the car price hike since the beginning of the year, due to new taxes.

Unilever denies tax-dodging charges

17-11-2018 08:00

Despite the taxes being cut from VND800 billion ($34.78 million) to nearly VND600 billion ($26 million), Unilever Vietnam continues to express dissatisfaction with the State Audit Office of Vietnam’s (SAV) proposal.

Disputes drag on over inconsistent tax incentives

26-11-2018 13:21

Foreign enterprises and local authorities continue to clash over inconsistencies related to preferential policies for expansion projects during 2009-2013.

No tax paying delay for closing businesses

09-11-2018 16:26

Tax payers and businesses that are completing their dissolution procedures shouldn’t be allowed to postpone their late tax payments and charges for late tax payment.

Solution near for tech giant tax limbo

18-10-2018 10:59

Applying the highest tax rate on advertisers of Facebook and Google seems to be the Vietnamese government’s latest solution to collect taxes from the technology giants, who still do not have representative offices in Vietnam and currently pass through a policy blind spot.

Tax implications on Vietnam’s bond market

31-08-2018 08:00

Through the long process of formation and development, the bond market in Vietnam has been growing in both depth and scale, proving its role as a medium for long-term capital mobilisation in the economy, as well as addressing the shortfall of the state budget.

Environmental protection tax on many commodities next year

24-10-2018 08:03

Lawmakers have decided to raise the environmental tax on a number of commodities from January 1, 2019.

Nestlé leading the way in tax compliance practices

05-11-2018 08:59

Nestlé Vietnam, a leading nutrition, health and wellness company, has picked up yet another accolade from a local administration, attesting to the company’s long-term investment and development commitment in the Vietnamese market.

New Zealand to tax tourists to fund infrastructure

15-06-2018 15:30

New Zealand announced plans Friday to introduce a tourist tax and increase other fees for international visitors to fund infrastructure development in the face of a tourist boom.

Traphaco and Cadivi fined for tax arrears

27-06-2018 21:59

The Hanoi Department of Taxation has just issued a fine of nearly VND1 billion ($44,000) to Traphaco JSC (code: TRA) and VND5.5 billion ($242,300) to Vietnam Electric Cable Corporation (Cadivi, code: CAV) for erroneous tax declaration.

Mobile Version

Mobile Version