Short tenor bonds surge in first quarter

|

|

|

|

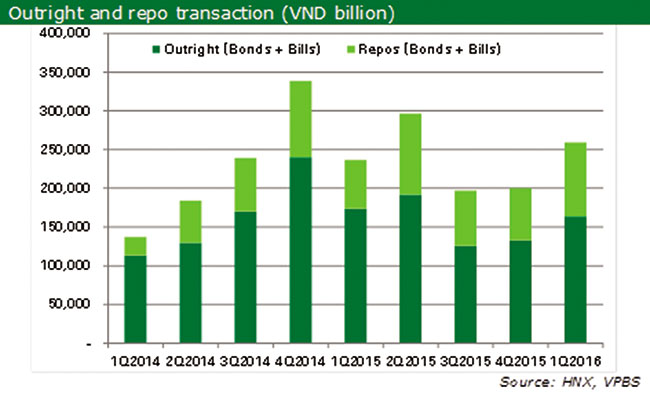

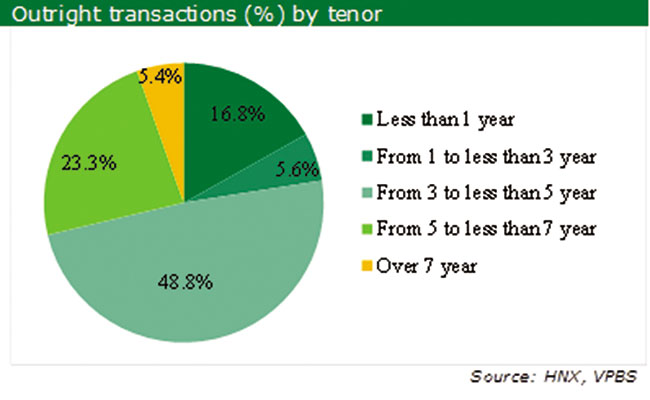

For outright transactions, bonds with maturities of less than five years have been very attractive to investors, with the transaction volume reaching VND116.62 billion ($5.23 million), representing 71.3 per cent of the total volume. In particular, bonds with maturities from three to less than five years accounted for nearly half of the total transaction volume.

Low credit growth during the beginning of the year was one of the factors causing money to flow into the bond market. The rising supply of short-term bonds on the secondary market since late last year also attracted investors due to their high liquidity and low risk.

Foreign investors returned as net buyers in the secondary market in the first quarter of 2016. Last year, the fears of a VND devaluation, following China’s currency devaluation, caused foreign investors to net sell VND5.5 billion ($247,000) in August alone. The Fed’s rate hike also prompted foreign investors to withdraw capital from emerging markets, including Vietnam. In the fourth quarter of 2015, foreign investors were net sellers of VND4,444 billion ($199 million), leading to a full-year net selling figure of VND1,366 billion ($61.3 million). However, the Fed’s opinion that the US economy is not ready to cope unsupported with the risks of the global economy has reduced the likelihood of it continuing to raise interest rates quickly, which has helped to curb capital outflows from emerging markets. This is one of the factors that helped stabilise exchange rates. So too has the timely actions of Vietnam’s central bank as well as rising remittances in the lead up to the Tet holiday. Overall, in the first quarter of 2016, foreign investors net bought a significant amount in the secondary market – VND6.33 trillion ($284 million).

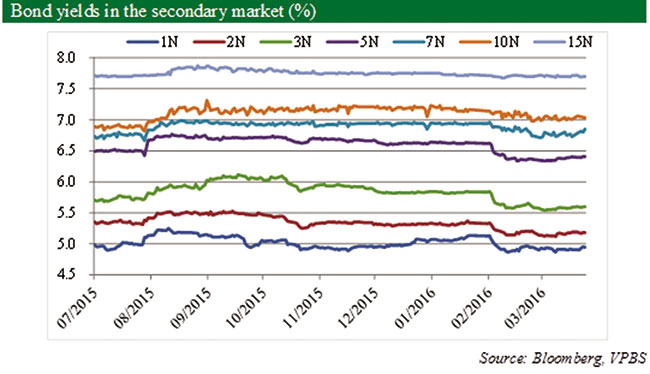

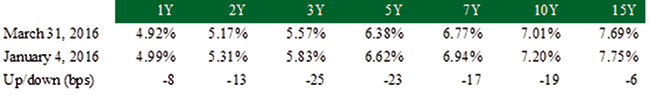

In the secondary market, bond yields fell between 6.0 and 25.0 basis points year-to-date, with three- and five-year yields declining the most – three-year bonds by 23.0 basis points to 5.57 per cent, and five-year bonds by 25.0 basis points to 6.39 per cent. The decline of bond yields was due to several factors, including credit growth slowing in the first quarter, high rollover demand for a large amount of bonds that came due in the first quarter of 2016, the USD/VND exchange rate remaining stable and even falling slightly during the quarter, and the rising supply of short-tenor bonds since late last year, which met the market demand for high liquidity and low risk.

Bond yields are expected to rise in the coming quarter for several reasons: increasing inflation and deposit rates, rising demand for capital for production and business activities in the near future, and the pressure to issue bonds to ensure state budget needs are met.

By Hoang Thuy Luong VP Bank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Mandatory biometric verifications to be expanded (December 19, 2024 | 10:37)

- Bank transfers lead to rebranding phase (December 19, 2024 | 09:00)

- Ownership of financial groups comes to fore (December 18, 2024 | 11:34)

- AI will be a game-changer in banking and finance (December 18, 2024 | 10:00)

- F88 partners with MB to transform over 850 financial stores into bank offices (December 17, 2024 | 18:04)

- Obstacles to stock-market upgrade to be removed (December 17, 2024 | 11:29)

- Vietnam seizes opportunities amid global trade shifts (December 16, 2024 | 18:00)

- Long-term perspective remains optimal approach (December 16, 2024 | 14:26)

- Fiscal measures to be based on upcoming US status (December 16, 2024 | 10:09)

- PetroVietnam accelerates divestment from PVI (December 16, 2024 | 06:59)

Mobile Version

Mobile Version