NA gives unprecedented approval to bank bankruptcy

|

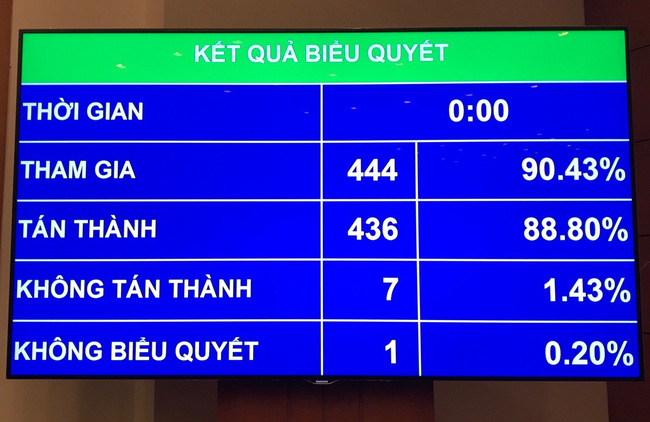

| Voting results: 88.8 per cent in favour, 1.43 per cent against, 0.2 per cent abstained |

This motion was one of the five plans to restructure CIs under special control as approved by the NA.

Specifically, 90.43 per cent of the delegates voted to amend and supplement a certain number of articles of the Law on Credit Institutions, and 88.8 per cent voted in favour of the amendments.

In accordance with the passed draft law, the five options for CI restructuring under special control were: restoration; mergers and acquisitions, consolidation, and transition of shares and capital contribution; business dissolution; compulsory transition; and bankruptcy.

A noteworthy addition, the option of bankruptcy for CIs has never before been pushed through the NA, marking a new chapter for the banking industry.

Vu Hong Thanh, chairman of the NA Economic Committee, stated that the NA’s amendment to rescue poorly-performing CIs under special control would significantly hurt market economy as well as increase financial burdens on the state by transferring to it copious non-performing loans and liabilities.

The State Bank of Vietnam (SBV) will take charge of submitting the decision of bankruptcy made by CIs under special control to the government, to ensure compliance with the regulations on legal remedies.

Le Minh Hung, Governor of SBV, highlighted that the top priority of SBV must be to secure the nation’s financial stability, the trust of citizens, and the legal rights of depositors regardless of whether ill-performing CIs under special control filed bankruptcy or not.

30 days after the government decided on opening the option of bankruptcy for CIs under special control, the special banking control board is in charge of co-ordinating with the CIs to secure the existing deposits in the Vietnamese territory as well as to plan the bankruptcy options which will in turn be submitted to SBV.

In case of constructing bankruptcy plans for people’s credit funds, the special banking control board is responsible of co-ordinating with the credit funds in question to secure the existing deposits in the Vietnamese territory and those under the management of Cooperative Bank of Vietnam (Co-opBank).

After 30 days of a filing for bankruptcy, SBV will take charge of considering and assessing the feasibility of the option, then submitting it to the government for approval.

The four key points emerging in the bankruptcy options are:

- Assessing the status quo and the handling process of CIs under special control undertaking bankruptcy proceedings;

- Assessing the impacts of the bankruptcy proceedings on the safety and security of the CI system;

- Constructing reimbursement tools for individual customers;

- Mapping the schedule of the bankruptcy process.

With regard to bankruptcy arrangements, SBV plays a vital role in providing guidelines, inspection, and supervision over the course of the implementation of the approved bankruptcy processes, which includes requesting the CIs under special control to file for bankruptcy at court. Additionally, in special events, SBV must seek approval from the government to amend and supplement the bankruptcy option.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cake and Visa collaborate to pioneer bank-led cross-border receivables solution (February 11, 2026 | 17:08)

- Oil and gas sector sees renewed momentum (February 11, 2026 | 11:45)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- Key concerns emerging in wake of rate hikes (February 11, 2026 | 09:00)

- Vietnam’s financial sector accelerates AI adoption, but security issue remains (February 10, 2026 | 15:37)

- Citi sharpens its focus on institutional banking (February 09, 2026 | 19:58)

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

Mobile Version

Mobile Version