Criminal Code turns stricter on social payments

|

| Companies will be pressed to adhere to regulations on employee insurance and benefit payments |

| RELATED CONTENTS: | |

| UK's Labour leader defies Brexit ouster vote | |

| Labour law conference requests FDI input | |

| Corporations and Partnerships in Vietnam | |

| Labour laws seen as hard work by firms | |

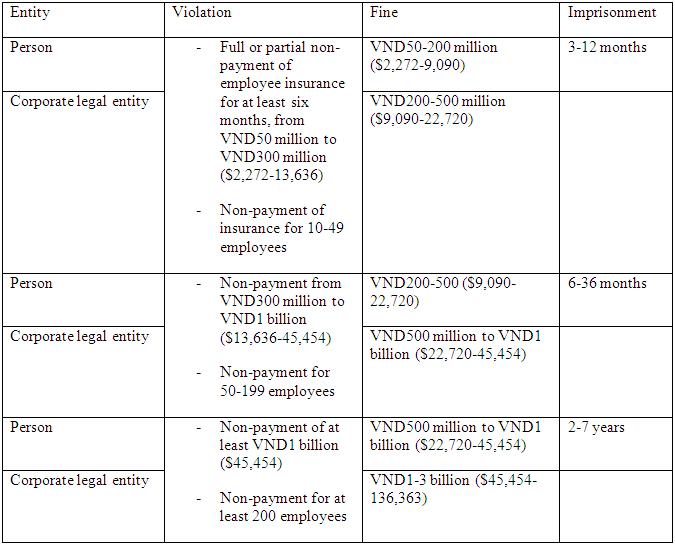

According to Article 216 of the revised Criminal Code, which will take effect on January 1, 2018, evading payments of social insurance, health insurance, and unemployment insurance for employees will face heavy punishments, including fines and imprisonment (see box for details).

In the 1999 Criminal Code, sanctions for evading the aforementioned payments remain unclear, making it hard for authorised agencies to punish violators.

Commenting on the sanctions in the new Criminal Code, Nguyen Lan Phuong, partner at US-backed law firm Baker & McKenzie Vietnam, told VIR that the VND1 billion ($45,454) fine for offenders is “still low, given that this crime involves and affects a large number of employees.”

“The monetary penalty should actually be higher to deter commercial legal entities from committing this act,” Phuong said. “The reality is that there are companies, including foreign-invested ones, which have been intentionally failing to pay insurance for their employees. This has caused serious impacts for employment-related government policies.”

Nguyen Thi Nhung, head of Human Resources at a Korean-backed garment firm in the southern province of Binh Duong, told VIR that these punishments are “suitable” and they “should be increased.”

“It is aimed to ensure equality for all firms. While many firms strictly abide by labour-related regulations, many have broken the law without facing any punishment,” Nhung said.

“The Criminal Law should clarify that in addition to facing these sanctions, violators shall have to pay all insurance packages in arrears for their employees, and even have to compensate for their employees’ losses,” she added.

Each month, Nhung’s firm has to pay VND2.5 billion ($113,636) for its 1,500 workers.

However, Tran Trong Binh, partner at a French-backed law firm based in Hanoi, argued that these sanctions can “horrify” enterprises who are now already facing burdens, such as high taxes and fees, as well as complex administrative procedures.

“But I think it will not be so easy for these sanctions to be implemented, because it is difficult to find out who is responsible for evading insurance payments out of the company’s management board, chairpersons, CEOs, general director, and chief accountant,” Binh told VIR.

“In another case, how can the money earned from the evasion of insurance payment be used remains a question. If it is used as part of the company’s revenue, it is one story, but if it is used for personal purposes, it is another story. This means sanctions will also have to be different,” he said.

Also according to the Criminal Code, new sanctions for violations in the illegal dismissal of employees are also stipulated.

Specifically, if a person for his/her own sake illegally dismisses or forces or threatens employees or public servants to quit their jobs, resulting in financial hardship, the offender will be subject to a monetary fine of VND10-100 million ($454.54-4,545), non-custodial reform of up to one year or imprisonment of three months to one year.

Violators will additionally be fined VND100-200 million ($4,545-9,000) or be sentenced to a one to three-year jail term if they illegally dismiss two employees or more or fire mothers of children under one year of age.

|

| New labour-related penalties |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- List of newly-elected members of 14th Political Bureau announced (January 23, 2026 | 16:27)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- List of members of 14th Party Central Committee announced (January 23, 2026 | 09:12)

- Highlights of fourth working day of 14th National Party Congress (January 23, 2026 | 09:06)

- Press provides timely, accurate coverage of 14th National Party Congress (January 22, 2026 | 09:49)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- Minister sets out key directions to promote intrinsic strength of Vietnamese culture (January 22, 2026 | 09:16)

- 14th National Party Congress: Renewed momentum for OVs to contribute to homeland (January 21, 2026 | 09:49)

- Party Congress building momentum for a new era of national growth (January 20, 2026 | 15:00)

Mobile Version

Mobile Version