Burdens still to be tackled to ensure efficient DPPA pilot

The European Chamber of Commerce in Vietnam (EuroCham) last week noted that the objective of 100 per cent clean energy is a challenging target but it is one that has become commonplace for global companies.

“To support these initiatives, we would welcome the immediate implementation of the direct power purchase agreement (DPPA) pilot scheme of 1,000MW capacity – with further expansion after the pilot, or correction of rules if not. There should also be an easing of the regulatory burden on companies wishing to implement clean energy plants,” said Tomaso Andreatta, chairman of EuroCham’s Green Growth Sector Committee.

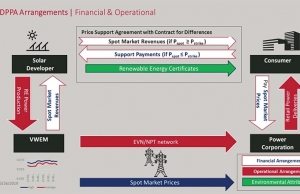

A DPPA would allow businesses in Vietnam to purchase electricity directly from private firms producing renewable energy, instead of through local power utilities. The measure would help individual companies to achieve their own clean energy supply targets.

It was noted that electricity from liquefied natural gas (LNG) plants will not assist EuroCham members in achieving their clean energy goal, as LNG is not a clean fuel from extraction to consumption. Therefore, the rising use of LNG to produce electricity will not increase the attractiveness of Vietnam as a manufacturing location when judged by the clean energy objective, according to the Green Growth Sector Committee.

|

| International developers have called for a direct power purchase agreement pilot for many years, Photo: Shutterstock |

The Ministry of Industry and Trade (MoIT) has prepared several draft legislative instruments since 2020 on the DPPA pilot scheme, including a May 2021 draft circular and October 2021 report, together with a May 2022 draft decision. These core documents provide an insight into the DPPA pilot’s likely structure and conditions, but no specific launch date for the scheme has been confirmed by the prime minister.

Unlike the latest draft circular, the decision does not describe the implementation and pricing mechanisms of transactions in significant detail, nor specify the criteria for participation in the programme. In addition, although it is not explicitly stated in the draft decision, a difference in the pricing mechanism is that power consumers will purchase power from Electricity of Vietnam at retail price rather than spot price, plus applicable fees and charges, as was stipulated under the draft DPPA circular.

Global firms had been ramping up calls for such a pilot over the years, with 26 top international companies and organisations purchasing more than 16 million mWh of electricity and boasting total investment in Vietnam of $1.57 billion, as well as signing a declaration of support for DPPA in Vietnam in 2019.

Vietnam has experienced a rapid deployment of solar (18GW) and wind (4GW) assets over the past three years. This has resulted in material issues around grid congestion and curtailment, requiring wholesale upgrades to Vietnam’s transmission infrastructure. As a result, the DPPA scheme is limited to an aggregate capacity of only 1,000MW.

The current draft Power Development Plan VIII acknowledges Vietnam’s existing grid overload and curtailment issues, with the MoIT committing to building 86 gigavolt-amperes of additional capacity for 500kV stations and nearly 13,000km of transmission lines, requiring up to $32 billion in investment to 2030.

| Stuart Livesey-Senior director Copenhagen Offshore Partners | |

For Vietnam to fully harness the potential that offshore wind (OSW) has to offer, it is imperative that a complete regulatory framework is set in place. This begins with the Power Development Plan VIII (PDP8). We hope that the government will soon approve the plan, which will serve as the overarching policy guidance that drives Vietnam’s development of renewables, OSW, and the energy sector. Given OSW’s vast potential to help the country deliver its commitment to net-zero by 2050, we would like to emphasise the urgency to immediately develop it in Vietnam. With the current draft PDP8 setting an ambitious target of constructing 7GW of OSW by 2030, there are only seven years left for Vietnam to deliver its first GWs of OSW. Therefore, related projects must undertake their consenting, development, and construction immediately if Vietnam is to have any chance of meeting these ambitious targets. As with any other emerging industries, Vietnam’s OSW industry must overcome significant technical, operational, and regulatory challenges. As such, it is imperative that a transparent, consistent, and accommodating regulatory framework be established. This may include but is not limited to marine spatial planning, a clear and consistent consenting and licensing route for projects, transparent investor selection mechanism, functional power purchase agreements, and incentives. As the Vietnamese government develops and fine-tunes the regulatory framework for OSW, it is critical that policies and mechanisms for offshore surveys consenting are prioritised and survey activities will then receive approvals and be allowed to commence this year to deliver 7GW of OSW by 2030. This is because offshore surveys typically take 2-4 years within OSW projects’ 6-8 years development timeline. Surveys provide indispensable prerequisite information and data for developers to plan future development steps and adapt to the constraints and necessary design parameters of a site. There is a need to comply with International Finance Corporation standards and environmental, social, and governance (ESG) commitments in developing regulations for renewables, especially new regulations for OSW. For large international developers, ESG is increasingly key as part of their working policy, as these companies need to meet global standards to satisfy lenders and international organisations. | |

| Le Cao Quyen-Chairman, Power Engineering Consulting JSC 4 | |

A transparent approach and reasonable pricing to entice investors are two of the most crucial factors. Power transmission must be the main priority of Vietnam’s energy development programme, and grid investment time is extended. The country can reach its goals if the government is enthusiastic about the energy transition and firmly committed to achieving net-zero carbon emissions. With the astonishing and quick development of wind and solar energy in Vietnam, it is important to stimulate investment by all power consumers in energy-efficient measures to achieve the nation’s related strategic goals. For this reason, the contribution of solar, biomass, hydropower, wind, and offshore wind power within the energy system should be maximised. Related to the DPPA mechanism which has been studied by the Ministry of Industry and Trade since 2018 – and as an important mechanism when moving to the retail electricity market, especially for renewable energy projects and large power customers – it is unlikely to be a feasible short-term application. This is because there are still not enough legal instruments for all participants to get involved and partly because of the lack of transparent information currently available in the domestic power market. |

| ABB’s next-level DPPA model advice Vietnam is already home to many multinational companies that are committed to going 100 per cent renewable or have established science-based targets to reduce greenhouse gas emissions. Brian Hull, country managing director of ABB in Vietnam, told VIR’s Phuong Thu about the company’s efforts to unlock access to corporate power purchase agreements in Vietnam as part of achieving a zero emission future. |

| DPPA pilot to put fresh wind in sail of renewable projects Direct power purchase agreements, which is a key driver of global renewable energy infrastructure – especially for wind and solar, are expected to pilot soon in Vietnam to attract private investment and meet the clean energy needs of international enterprises. |

| Strong DPPA scheme desired The Minister of Industry and Trade is likely to sign a draft circular regulating a pilot project for electricity purchases and sales between renewable energy generators and consumers under direct power purchase agreements. However, while the ministry is gaining support from some organisations, experts advise designing the schemes in an appropriate manner. |

| DPPA pilot to prompt low-carbon adoption Vietnam’s much-awaited direct power purchase agreement pilot will be an effective tool for global companies to meet their sustainability commitments, but it remains to be seen how Vietnam can meet the green energy demand from global businesses. |

| Vietnam to become green manufacturing hub by 2050 through net zero approach Vietnam’s commitment to achieving net zero emissions by 2050 at COP26 is expected to bring a tailwind of opportunities, helping to turn the country into a green manufacturing hub and facilitating the export of made-in-Vietnam products into the markets of developed nations. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

- Bac Ai hydropower works stay on track despite holiday period (January 16, 2026 | 16:19)

- Fugro extends MoU with PTSC G&S to support offshore wind growth (January 14, 2026 | 15:59)

- Pacifico Energy starts commercial operations at Sunpro Wind Farm in Mekong Delta (January 12, 2026 | 14:01)

Tag:

Tag:

Mobile Version

Mobile Version