Advanced search

Search Results: 130 results for keyword "Ha Tam".

Gold sellers prepare for Caishen Day annual rush

23-02-2018 16:27

On the tenth day of the first month of every lunar year, aka Caishen Day attributed to the sacred God of Wealth, domestic gold buyers stream to gold stores due to the common belief that great fortune would be bestowed upon whoever purchases gold on that day.

Alibaba and “40 thieves” move in on e-payments

17-02-2018 08:00

The e-payment market in Vietnam is becoming more competitive than ever, as various fintech providers around the world start flocking to the fast-growing country. This poses a real challenge for commercial banks, who must now adapt to the breakneck development speed of Industry 4.0.

Agoda and Booking.com in crosshairs of customers and authorities

06-02-2018 18:37

Booking sites Agoda and Booking.com have drawn customers’ ire by their oversight in keeping customers’ personal information secret, while at the same time the authorities have detected signs of tax evasion.

Who would reap benefits from surging Euro?

27-01-2018 15:25

Over the span of 2017 and the first three weeks of 2018, the price of the euro surged, causing mild unease among import-export businesses despite Vietnamese exports to the European Union (EU) hitting $40 billion per year.

Bad debts auctions on the roll

25-01-2018 20:00

In late 2017 and early 2018, thousands of billions of dongs were retrieved by domestic banks, giving off signals of a new bad debt market being born.

Bank-fintech teams tackle mobile pay

11-10-2017 09:20

Handshakes between financial technology firms and local banks have become a growing trend in the face of the current boom in mobile payments.

Major banks accelerate listing preparations

15-08-2017 11:13

On August 17, VPBank will be officially listed on the Ho Chi Minh City Stock Exchange (HoSE). Including this, there are at least four major bank listings in 2017, and so far, this trend has shown no signs of stopping.

Bad debts dampen M&A boom in banking industry

10-08-2017 13:01

As Resolution No.42/2017/QH14 on the pilot settlement of credit institutions’ bad debts is enacted, it is hoped that bottlenecks for mergers and acquisitions (M&A) activities in the banking industry will be removed and more M&A deals will be implemented soon.

Increasing M&A for financial institutions

04-08-2017 19:17

Mergers and acquisitions (M&A) for financial institutions are luring in numerous domestic and international investors due to the attractiveness of the rapidly developing, $26.55-billion consumer finance market.

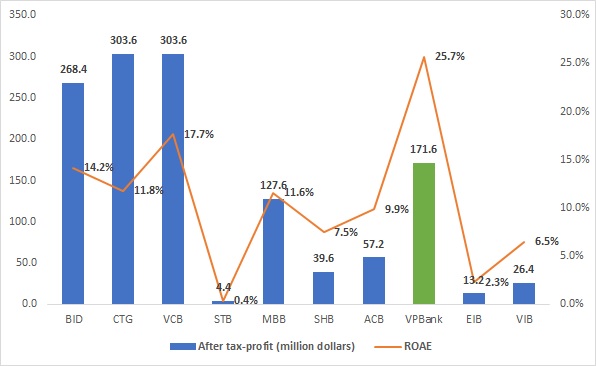

Banks report profits, experts worry

13-07-2017 20:47

Numerous commercial banks have reported rising profits in the first half of 2017. However, experts have raised concerns over this growth.

Commercial banks prowling Vietnamese retail business

05-07-2017 11:31

Commercial banks in Vietnam are racing to develop their retail banking segment, heating up the competition in the market.

Economists suggest dealing with bad debts before meting out punishment

10-06-2017 16:51

The National Assembly (NA) was discussing bad debts settlements and how to deal with those responsible for these bad debts, with the hope that there will be detailed regulations on solving these problems, bringing about liquidity and transparency in the economy.

Tentative banks slow hi-tech agricultural credit package

21-05-2017 21:02

There is a VND130-140 trillion ($5.72-$6.16 billion) credit package for hi-tech agricultural projects, however, few firms have been able to access it due to cautious banks.

Secret weapons in exchange rate operations

05-05-2017 15:26

The secret and most important weapons for the State Bank of Vietnam (SBV) to operate the exchange rate are the foreign currency trading volumes and the daily average exchange rate.

VND0 takeover or bankruptcy?

10-04-2017 09:51

The method of acquiring weak banks at VND0 is officially adopted on the draft law on supporting the restructuring of credit institutions and non-performing loan (NPL) settlement, composed by the State Bank of Vietnam (SBV). However, buying at the price of VND0 or boldly letting poorly performing commercial banks go bankrupt remains a dilemma.

Mobile Version

Mobile Version