KIDO frozen food division announces IPO

|

On March 27, KDF will organize a roadshow to provide more information about the IPO after which KDC expects to possess 65 per cent of KDF’s chartered capital instead of the current 99.8 per cent.

In 2016, KDF transformed its operations from a limited liability company to a joint stock company.

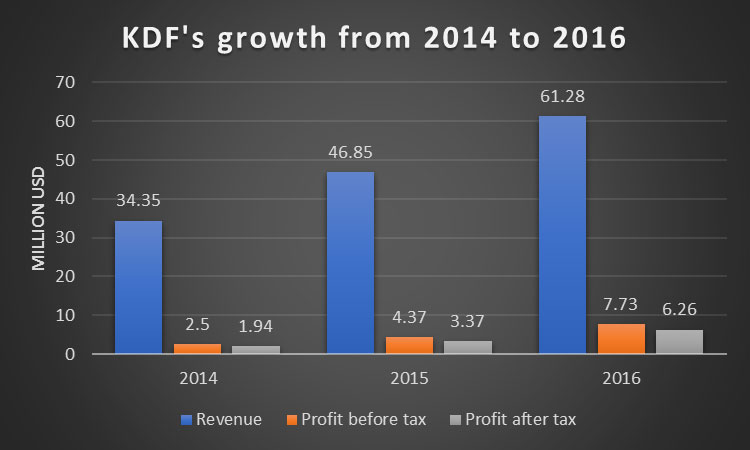

KDF’s exponential growth in the recent years is expected to attract investors. In 2016, KDF's revenue reached $61.28 million, increasing 31 per cent on-year. Its before and after tax profits reached $7.72 million (+77 per cent) and $6.27 million (+85 per cent), respectively.

|

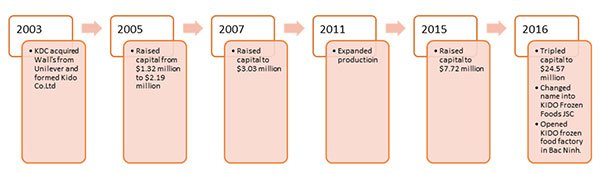

KDF was founded in July, 2003, a product of KDC’s acquisition of Wall's from Unilever. With this lucrative yet pressuring acquisition, KDF has inherited the international-standard ice cream manufacturing system, including the most modern ice cream factory in Southeast Asia. KDF has become the leader of the Vietnamese ice cream industry with a 35 per cent market share in 2016, with its flagship brands Merino and Celano, which take up 19 and 13 per cent, respectively.

Throughout its 14 years of operation, KDC has continuously raised its capital in KDF. In 2015, KDF elevated its chartered capital from $3.03 million to $7.72 million. In 2016, the figure was tripled to $24.57 million. KDC states that the recent major increase in chartered capital is meant to ensure the financial force for investment in new factories and keep the debt-to-equity ratio in check after it increased considerably in 2015.

|

| KDF’s progress over 14 years |

KDF owns two factories: Cu Chi ice cream factory and Bac Ninh frozen food factory with a total designed capacity of 50 million litres per year, in which ice cream capacity is 25 million litres per year and yogurt capacity is 25 million litres per year.

KDF has started expanding its frozen food manufacturing facilities to approach more customers and focuses on upgrading its ice cream manufacturing system to reach international standards.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Deputy PM meets lead US negotiator for trade talks with Vietnam (April 11, 2025 | 12:23)

- 5G infrastructure receiving push due to bespoke policies (April 11, 2025 | 10:37)

- Celebrating the Vietnamese journey to innovation (April 11, 2025 | 10:27)

- MoF seeks business proactivity in ESG (April 11, 2025 | 09:49)

- Diversity felt in retail models and spaces (April 11, 2025 | 09:02)

- Foreign brands keep up their convenience store dominance (April 11, 2025 | 08:56)

- Marvell Group expands cooperation in human resource training for semiconductor industry (April 10, 2025 | 17:47)

- New tariff pressures spark structural shift in Vietnam’s timber sector (April 10, 2025 | 16:52)

- HKFYG Celebrates Completion of Hong Kong International A Cappella Festival (April 10, 2025 | 14:35)

- Galaxy Macau, MPU Host 'Scrolls of Stars' Exhibition at GalaxyArt (April 10, 2025 | 14:27)

Mobile Version

Mobile Version