Foreign investors point out difficulties and solutions for SOE equitisation

|

| Equitisation process: too much for too little |

Tony Foster, managing partner of Freshfields Vietnam, said that foreign investors are clamoring to spend billions of USD to buy stakes in the 150 large-scale state-owned enterprises (SOEs) in Vietnam, but they do not know how.

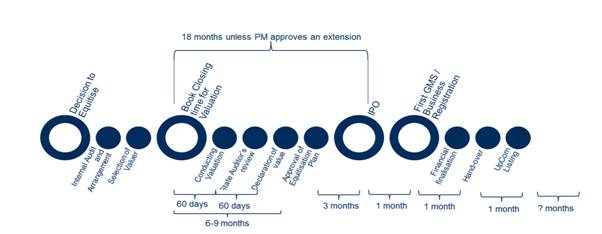

“It is because everything remains unclear. Why is the sales process of large SOEs stuck? Foreign investors are facing many difficulties in participating in the SOE equitisation. The biggest ones include the price and process not being transparent, small percentage for sales, and unclear assets andrights,” Foster said at yesterday conference titled “SOE Equitisation Eyed by Foreign Investors” organised by AmCham and the National Assembly’s Economic Committee.

“For example, it takes too long to complete equitisation, while the stakes on sale remain too little. It is also suggested that the government remove the foreign shareholding cap of 49 per cent to attract more potential investors that may be interested in the controlling rights of the target companies,” he stressed.

Currently, only eight deals between large SOEs and foreign strategic investors have been completed. The largest equitisation deal in Vietnam so far was in 2013, when Japan’s Bank of Tokyo-Misubishi UFJ acquired 20 per cent of VietinBank for $743 million.

The remaining deals involved relatively smaller stakes compared to foreign investors wallets, such as Carlsberg’s buying 17.08 per cent of Habeco ($115 million), Mizuho’s buying a 15 per cent stake in Vietcombank ($550 million), ANA buying 8.77 per cent of Vietnam Airlines ($109 million), HSBC buying 18 per cent of Bao Viet Insurance ($350 million), JX Nippon & Energy buying 10 per cent of Petrolimex ($117 million), and Itochu’s acquisition of 5 per cent in Vinatex.

“These investors are waiting to see a rise in the foreign ownership limit (FOL) so that they can purchase more stakes from these SOEs,” Foster said.

According to Vo Ha Duyen, senior partner at law firm Vilaf, the existing FOL of 49 per cent is “preventing foreign stake purchasing, money flows, and especially the government’s efforts to achieve successful divestment of SOEs. It is also causing difficulties for the government to mobilise capital from private investors, which is especially concerning as the state budget is limited.”

Nguyen Duc Kien, Vice Chairman of the National Assembly’s Economic Committee, stressed that slow equisitation “has been seriously affecting investors, especially foreign ones who are eager to purchase more stakes from SOEs.”

“Over the past years, though 96.5 per cent of SOEs have been equitised, only 8 per cent of the state’s capital has been transferred to private investors,” Kien said.

According to Foster, the slow equitisation is also due to the fact that many SOEs do not know how many types of assets and capital they currently have. This has made it very hard for the government and foreign investors to make valuation.

Currently, strategic sales in seven large SOEs remain stuck. For example, Mobifone’s equitisation plan was first announced in 2005, but no progress has been made to date. PV Oil in 2012 planned to sell up to 25 per cent to the public, including 20 per cent to strategic investors, but the plan remains delayed so far.

In other cases, Dung Quat Refinery plans to sell stakes in 2013-2014, but has been delayed to date. PV Power last year planned to sell 25 per cent to the public, including strategics investors, but no progress has been made just yet.

Other firms’ strategic sales are also in a standstill, including Airports Corporation of Vietnam, EVN's Gencos, and Vinachem (delayed since 2015).

In addition, four large SOEs remain stuck in divestments. For example, Vietcombank wants to divest 7.7 per cent of its shares for $400 million—with GCI interested but unable to meet the price. Besides, the state plans to divest 54 per cent of Sabeco and further stakes in Habeco, but the processes remains unknown. Vinamilk also wants to sell further stakes, after selling a part to F&N.

“The government would need to clarify SOEs’ operations and the equitisation method. What can foreign investors do after they buy the stakes? Foreign investors want to see whether their rights will be protected after the purchase. They need to have management rights to protect their investment,” noted Adam Sitkoff, executive director of AmCham Hanoi.

According to Sitkoff, if the government wishes to maximise revenue from equitisation and increase investors’ confidence, “it is necessary to let them provide a transparent equitisation and divestment process, with all information about enterprises in clear view for investors.”

Jonathan Ooi, an expert from PriceWaterhouse Coopers, said there is a big gap between enterprises and investors in corporate valuation—one of the biggest difficulties stopping investors from buying SOE stakes. “There needs to be an independent valuation unit which operates under international standards. Investors can make big investment decisions when they see a balance between risks and benefits,” he said.

| Government details SOE divestment plan until 2020 Deputy Prime Minister Vuong Dinh Hue has approved a list of 406 State-owned enterprises (SOEs) marked for divestment from now until 2020. |

| SOE divestment returns $300 million to State coffer State-owned groups and enterprises have brought back VND6.84 trillion (US$301 million) to the State coffer during their divestment process in 2016, according to the Finance Ministry. |

| SOE divestments hit snags Several State-owned enterprises (SOEs) are facing difficulties withdrawing their investment from non-core businesses, even though this September is the deadline for them to do so. |

| Step-by-step SOE divestment Divesting from non-core businesses should not be taken on an extensive scale, but aim at state-owned enterprises (SOEs) active in areas in which the state holds a monopoly. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

Mobile Version

Mobile Version