Bond market spikes on improved CPI

The consumer price index (CPI) growth fell from 23.02 per cent in August 2011, to 7.5 per cent in August 2013, to 6.04 per cent in December 2013. In June 2014, CPI rose 4.98 per cent on-year, recovering from the bottom of 4.39 per cent reached in March 2014 which posted the lowest since August 2009.

Inflation in 2013 was just 6.04 per cent on year, well below the 8 per cent level set by the National Assembly’s socio-economic development resolution and within government target of 6 per cent to 6.5 per cent. This was the second year Vietnam has contained inflation within the National Assembly’s and government’s targets.

The State Bank of Vietnam’s (SBV) determination to effectively control money supply combined with declines in the world prices of major basic commodities contributed to the fall in Vietnam’s CPI.

Trade and foreign direct investment (FDI) were also major contributing factors. Significant improvements in Vietnam’s balance of trade and strong FDI inflows have brought large amounts of foreign currency into the country. The SBV capitalised on these flows to stabilise foreign currency reserves with radical measures including raising required reserves and capping deposit interest rates in US dollars; restricting offshore borrowings by domestic entities and reducing the position in foreign exchanges of banks. This resulted in Vietnam having its highest level of foreign currency reserves in its history, giving the SBV the power to support the value of the VND. In spite of the recent 1 per cent devaluation, the VND has been largely unchanged over the past two years. A stable currency has prevented increases in the prices of imports and has therefore contributed to the lower inflation rates.

While Vietnam’s CPI has been on a downwards trend since last September, the CPI of neighbours like Indonesia, Philippines and Thailand have been on the rise.

Low inflation has helped to make Vietnam’s bonds more attractive than those of its peers. We have calculated the inflation adjusted or “real” bond yields in these four countries, comparing the one-year bond yields and the annual CPI a year later. The results show that Vietnam’s one-year bonds have continuously offered the highest real return from April 2011 until now. Vietnam’s bonds have provided positive real yields since April 2011. In the meantime, real yields of Indonesia have been declining until recently and have been negative since February 2012. Those of the Philippines stayed below zero for most of this time. Thailand’s real yields seemed to have moved in tandem with those of Vietnam, but at significantly lower levels.

The low levels of CPI maintained since the middle of 2012 brought about two outcomes in the bond yields. First, we note that the yields 10-year and two-year bonds have been on the decline in general since April 2012, except for the rise in two-year yields during the summer of 2013 following the exit of foreign investors and rising CPI. Second, the decline in 10-year yields has been less than those in the 2-year tenure, leading to the yield spread widening since then.

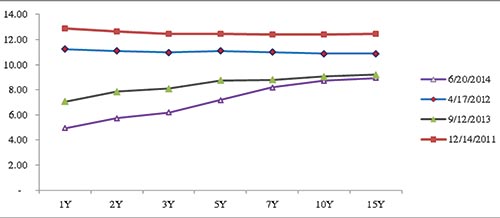

Previously, the yield spreads were negative from December 2011 to April 2012, implying an inverted yield curve. Their shift from negative to positive positions suggested that the yield curves became normal and then steepened. As shown in the chart, the yield curves first shifted downwards from December 14, 2011 to April 17, 2012; then reached its steepest shape by June 20, 2014.

The movements are all compliant with the theory, which says that an inverted curve can serve as an indication that the economy will soon experience a slowdown, which causes future interest rates to give even lower yields. Before a slowdown, it is better to lock money into long-term investments at present prevailing yields, because future yields will be even lower.

Thanks to the slowing of CPI and the stability of the foreign exchange rates, Vietnam has attracted foreign capital into its bond market, making it among the most robust bond market in the region.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- From easy money to selective bets: investment prospects for Vietnam in 2026 (January 06, 2026 | 16:51)

- Stock market starts 2026 with growth and governance in focus (January 06, 2026 | 08:45)

- Cake by VPBank posts strong gains in scale and efficiency leveraging AI focus (January 05, 2026 | 18:55)

- Banks step up listing plans in 2026 to strengthen capital and transparency (December 31, 2025 | 18:59)

- Ho Chi Minh City projects $10.5 billion remittance inflows in 2025 (December 31, 2025 | 18:58)

- New decree sharpens enforcement in securities market (December 31, 2025 | 18:53)

- Gold market reform advances as SBV receives applications for bullion production (December 30, 2025 | 12:07)

- EVN and AFD sign credit agreement for Vietnam’s first pumped storage hydropower plant (December 30, 2025 | 10:06)

- Techcombank Priority Visa Signature unlocks a higher standard of living (December 29, 2025 | 16:44)

- Tax sector wraps up 2025 and sets priorities for next year (December 25, 2025 | 14:00)

Mobile Version

Mobile Version