Basel II inevitable for Vietnamese banks

|

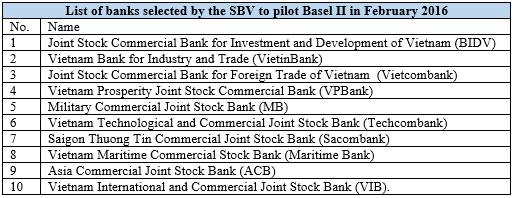

Ten to pilot, all to follow

At the beginning of the year, the State Bank of Vietnam (SBV) issued Directive No. 01/CT-NHNN on implementing monetary policies and ensuring safe and effective banking operations. One of the focuses of the directive is that in 2017, the project to restructure financial institutions and deal with impaired loans in the period from 2016 to 2020 will be conducted, in the framework of which Basel II will be researched and applied to bring banks closer to meeting international standards.

|

According to the directive, the whole banking system, not just the ten banks named in February 2016, will have to apply Basel II standards soon.

General director of Orient Commercial Joint Stock Bank (OCB) Nguyen Dinh Tung stated that the application of Basel II standards is important to integrate with the global banking system, protect customers, and reduce risks and mistakes.

“However, Basel II proscribes strict criteria for legislation, database management, capital adequacy, and so on, so its application is challenging,” he shared. To deal with this, the OCB prepared a database and funds as the two pillars of risk management. By November 2016, OCB had completed the first stage in its Anti-Money Laundering (AML) project. The bank is completing the final stages to officially apply Basel II in the third quarter of this year.

The only way to reduce risk.

Basel II is a set of international banking regulations put forth by the Basel Committee on Bank Supervision (BCBS), which sets minimum capital requirements for banks and requires banks to apply risk management methods.

In Vietnam, to apply Basel II, banks must deal with expenditures on investment and technology, human resources, and historical transaction data, among others.

In the project draft to restructure the economy from 2016 to 2020, prepared by the Ministry of Planning and Investment, some goals are set, such as cutting back non-performing loans, reducing the number of weak banks, and assuring 70 per cent of banks apply Basel II in 2020.

Dr Nguyen Tri Hieu, a financial specialist, believed that the application of international standards is necessary for risk management and to reduce the probability of default, creating trust among depositors.

Dr Nguyen Van Thuan, head of the Finance and Banking Department of Ho Chi Minh City Open University, said that the difficulty lies in enhancing Vietnamese banks’ capital resources, especially for small banks.

| RELATED CONTENTS: | |

| Vietnamese banks overly dependent on credit growth | |

| BEPS action plan in APEC to be deployed | |

| Analysis: Basel II bank performances | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

Mobile Version

Mobile Version