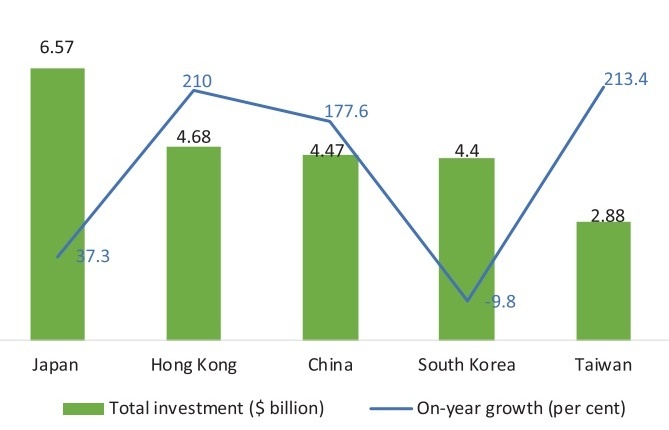

Decentralisation’s pros and cons

December 24, 2012 | 13:54

Despite bringing about positive effects in attracting foreign direct investment (FDI), decentralisation leaves corollaries. In order to secure the national interest in calling for more quality FDI, it’s high time to improve this mechanism.

Landmark law to tackle money laundering

July 09, 2012 | 11:44

Vietnam has been cited for a number of years as being a destination for international money launderers. Now, a landmark local law is expected to have a noteworthy impact on cleaning up the dirty money problem. Tony Nguyen and Nguyen Nu Thuy Linh, attorneys at EPLegal take a closer look at the law’s potential benefits and shortcomings.

Legal gears ready to kick in

February 13, 2012 | 08:47

Vietnam’s industrial zones (IZs), export processing zones (EPZs) and economic zones (EZs) have blossomed over the past 20 years thanks to the development of a raft of policies and mechanisms conducive to investment attraction, writes Vu Dai Thang, Director of the Ministry of Planning and Investment’s Department of Economic Zones Management

Taking care of RO operations

September 25, 2011 | 23:27

KPMG’s advisors Nam Nguyen and Hoang Anh Tuan provide valuable insights on what representative offices need to know to ensure they stay within the law in Vietnam.

Transfer pricing a serious issue

August 29, 2011 | 07:37

Transfer pricing is one of the key issues in tax authorities’ audit and companies’ tax governance and business decision-making in related party deals.

The competitive edge

June 13, 2011 | 08:00

Vu Ba Phu, deputy director general of Vietnam Competition Authority under the Ministry of Industry and Trade, discusses the practicalities of M&A activities in Vietnam.

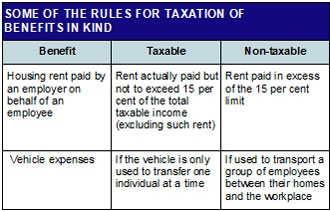

Lowdown on tax for expatriates

January 24, 2011 | 08:00

“Vietnam is a great destination for expatriates, provided the intricacies of the tax and regulatory system are properly navigated”

Steep learning curve to walk in step with the WTO

January 03, 2011 | 10:26

“Without sufficient clarification and instructions from the Ministry of Finance or State Bank on the issue, the above requirements will be evident barriers against foreign banks trying to establish a joint venture or wholly foreign-owned bank in the coming time?”

VAT afloat in a confused sea

October 03, 2010 | 21:45

With the introduction of new Value Added Tax (VAT) regulations, effective from January 1, 2009, many areas of interpretation and implementation remain ambiguous and certain contemporary VAT issues encountered by taxpayers remain, write KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun.

Labour rules are hard work

September 27, 2010 | 06:06

Vietnam’s Labour Code, adopted in 1994, has created a cohesive and comprehensive legal framework for a new labour regime.

Road to ignite prices

August 03, 2010 | 09:52

KPMG Vietnam tax partners Ninh Van Hien and Do Thi Thu Ha look at the tax up and downsides of Vietnam’s real estate market.

1 2

Mobile Version

Mobile Version