Signs of M&A flourish in healthcare arena

August 30, 2023 | 10:14

While mergers and acquisitions in Vietnam’s healthcare sector show some signs of flourishing, the sector needs more drivers to grow.

Big deals making a mark within industrial real estate

August 28, 2023 | 08:00

The trend of shifting supply chains to key destinations, including Vietnam, has provided an opportunity for the country to attract foreign capital flows and become a focal point of the industrial real estate sector.

Strong recovery projected in Vietnam’s M&A arena in 2024

June 27, 2023 | 10:19

Vietnam’s merger and acquisition market has been slower than expected in 2023, but there is still growth compared to 2022.

Fundraising challenges must be navigated in uncertain M&A market

June 20, 2023 | 17:00

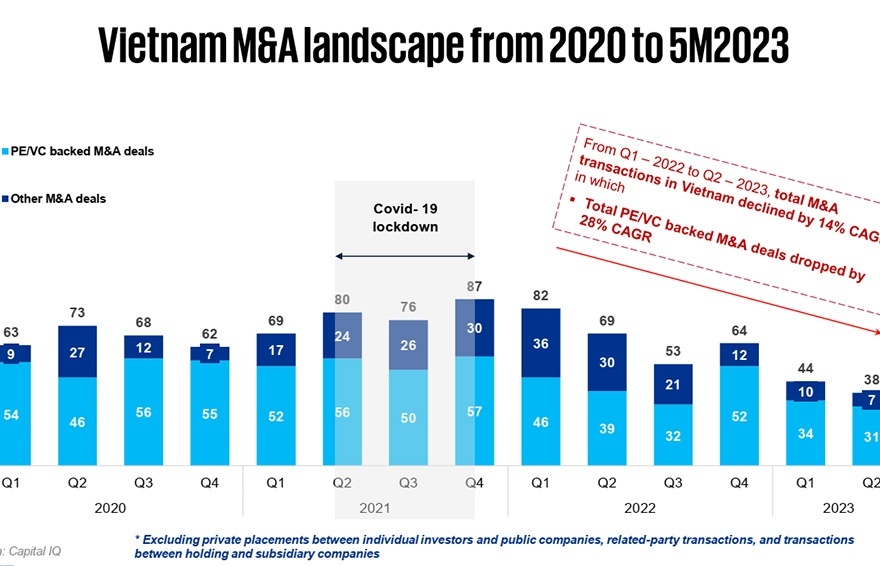

Warnings about a slowdown in the Vietnam merger and acquisition market, particularly for investment from private equity and venture capital (PE/VC), were raised in late 2022. As of now, we are experiencing one of the toughest downturns.

Concocting a defensive M&A strategy to build resilience

April 26, 2023 | 10:19

Today’s economic situation can be a catalyst for opportunity through mergers and acquisitions to facilitate businesses to build resilience. Le Viet Anh Phong, financial advisory lead at Deloitte Vietnam, spoke with VIR’s Luu Huong about the strategies expected to prevail this year.

Vibrant activity felt with real estate M&A

April 05, 2023 | 10:27

Merger and acquisition activities in the first months of the year surged with several huge deals, signalling the Vietnamese market is ready to welcome foreign investors into projects thirsty for capital.

Legal due diligence and major red flags for energy projects

February 22, 2023 | 15:10

Mergers and acquisitions can play a critical role for the power sector to flourish with a boosted financial model for investors with distinct appetite. Vaibhav Saxena, lawyer at Vilaf, looks at existing assets, assets under construction, and planned projects that have a special purpose vehicle.

Global CEOs resolute in M&As

February 22, 2023 | 11:00

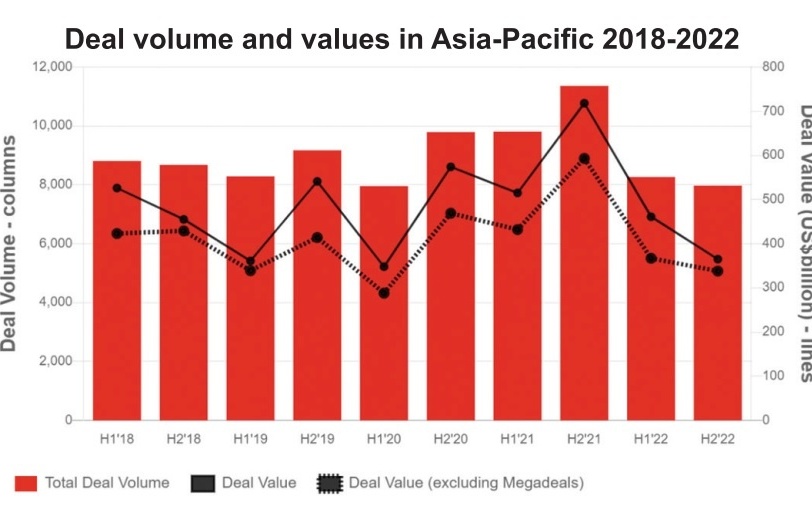

Global merger and acquisition (M&A) activities will likely rise later in 2023 as investors and executives look to balance short-term risks with their long-term business transformation strategies, according to PwC’s 2023 Global M&A Industry Trends Outlook.

Tech groups hope for boost via M&As

December 29, 2022 | 13:00

Driven by acceleration in digital transformation, technology is emerging as a high-potential industry for merger and acquisition transactions in Vietnam.

The state of play in healthcare M&As

December 16, 2022 | 11:40

Merger and acquisition moves are one of the more effective measures for foreign investors entering the Vietnamese medical and pharmaceutical industry, utilising available factories and inexpensive labour. Ngo Thanh Hai, Nguyen Dieu Quynh, and Le Anh Thu from LNT & Partners offers an overview of the factors and barriers involved when it comes to dealmaking in pharma.

SABECO ignites opportunities with streamlining overhaul

November 30, 2022 | 10:46

Saigon Beer-Alcohol-Beverage Corporation is on track to further activate its transformation agenda that will strengthen its operational capabilities and modernise its governance system.

Experts look to 2023 for top M&A deals

November 30, 2022 | 10:13

Although the merger and acquisition market in Vietnam has been slow going in 2022, opportunities next year should be abundant even despite concerns from prolonged global economic storms, according to various insiders.

Domestic corporations turn to global credit financing sources

November 30, 2022 | 09:51

Given current challenging fundraising and bleak merger and acquisition circumstances, a number of Vietnamese groups are looking to financing sources from overseas credit facilities to strengthen their resilience in the face of market fluctuations.

Asian investors still on lookout for deals

November 30, 2022 | 09:00

Having been the dominant players in Vietnam’s merger and acquisition market for years, new activities from Japanese, South Korean, and Singaporean investors are demonstrating that interest in the fast-growing market remain unchanged.

M&A Vietnam Forum 2022: 'Igniting new opportunities'

November 23, 2022 | 16:02

The 14th Vietnam M&A Forum 2022 organised by Vietnam Investment Review under the auspices of the Ministry of Planning and Investment took place in Ho Chi Minh City on November 23.

Mobile Version

Mobile Version