FIEs seek streamlined workforce policy

September 29, 2022 | 18:34

The human resources of Vietnam are improving to meet the demand of foreign-invested enterprises. However, they may require stronger policies on visas to enhance performance and transfer high technologies to Vietnam

Domestic companies striving to become trusted vendors of FIEs

September 23, 2022 | 14:00

Numerous foreign-invested enterprises are looking for more Vietnamese vendors, but domestic companies are being encouraged to make improvements before they can effectively climb global supply chains.

FIEs upholding equality in workplace

April 27, 2022 | 14:58

Approaching and solving gender issues on the basis of respect for diversity and difference is a strategy being pursued by many foreign-invested enterprises in Vietnam in order to establish an equal working environment with inclusive benefits for all staff.

Listing frenzy for FIEs and domestic giants

December 11, 2021 | 11:55

While the number of listed foreign-invested enterprises remains highly limited on Vietnam’s stock market, local conglomerates are still making headway to overseas listings as a part of their worldwide expansion initiatives.

Taking advantage of beneficial agreements

September 02, 2021 | 10:00

Vietnam’s economy is showing steady growth – however, much more is needed for the survival and development of businesses. Bui Ngoc Tuan, tax partner of Global Trade and Customs at Deloitte Vietnam, shares his insights on the resources businesses can utilise to take advantage of cross-border transactions.

FIEs seek support over social insurance payout schedules

June 04, 2021 | 14:00

In the context that the production and business situation continues to be severely affected due to the latest outbreak of COVID-19, foreign-invested enterprises in Vietnam are looking to suspend or extend deadlines for payment of social insurance premiums, just as the Vietnamese government has reduced and exempted taxes since last year.

Value sharing and opportunities for Vietnamese suppliers in global value chain

May 05, 2021 | 08:00

MNCs and FIEs increasingly focus on sustainability in their cooperation with local suppliers to elevate SMEs to become part of global supply chains.

ASEAN-wide tax race for FDI a road leading into the abyss

July 16, 2020 | 09:00

ASEAN countries should stop offering aggressive tax incentives in order to attract foreign funds, as it could create an unfair business climate among enterprises and lead to an acute state budget deficit.

FIEs displeased with government demand to license internal websites

July 04, 2020 | 21:55

The new regulations of the MIC may affect the policies and assets of private businesses and foreign-invested enterprises in Vietnam.

Harnessing further FDI to Vietnam

May 02, 2020 | 08:00

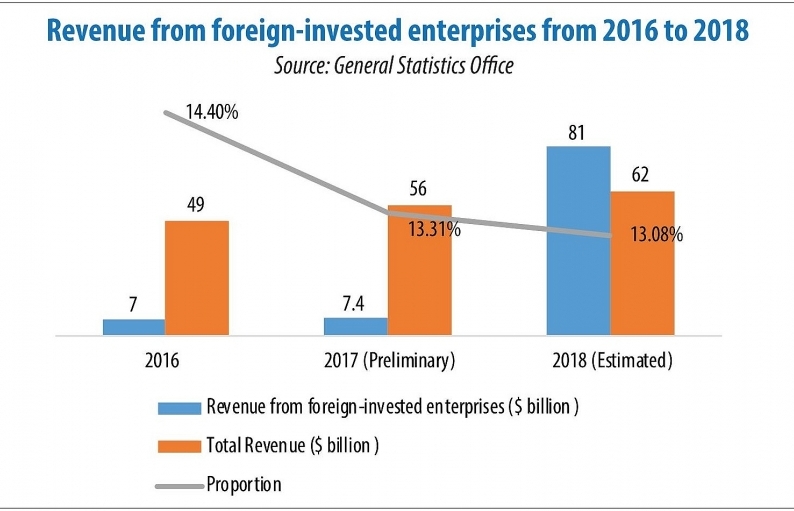

Since national reunification in 1975, Vietnam’s economy has grown from strength to strength. Senior economist Nguyen Mai writes about how the economy has developed in that time, with foreign direct investment serving as one of the key driving forces.

Scrutinising rules for transfer pricing

April 30, 2020 | 08:00

The implementation of the government’s Decree No.20/2017/ND-CP dated February 2017 and Circular No.41/2017/TT-BTC dated April 2017 – both effective from May 2017 and applied from the fiscal year of 2017 onwards – has raised several concerns among taxpayers regarding transfer pricing (TP) rules.

Crunch time for labour-intensive areas

April 21, 2020 | 11:00

As the country faces an unexpected economic crisis, industrial zones are reeling to protect enterprises vulnerable to diseases, especially those labour-intensive businesses that play an important role in the nation’s exports.

Two foreign banks' representative offices have licences withdrawn

April 14, 2020 | 16:28

The SBV has withdrawn the licences of the representative offices of Kookmin from South Korea and Commonwealth Bank of Australia.

Maintaining business stability a top task for foreign investors

April 08, 2020 | 15:00

Amidst the complicated developments of the acute respiratory infection that has grown into a global pandemic, foreign-invested enterprises are struggling to maintain business as usual, and taking measures to curb the spread of the virus and ensure employees’ health.

Aligning transfer pricing with international norms

February 17, 2020 | 09:07

The growth of foreign-invested enterprises (FIEs) in Vietnam has recently raised increasingly complicated tax concerns. These problems arise primarily from the practical issues of determining the transaction price between FIEs and their related parties.

Mobile Version

Mobile Version