Investor knowledge crucial for safe corporate bond investment

October 29, 2022 | 22:20

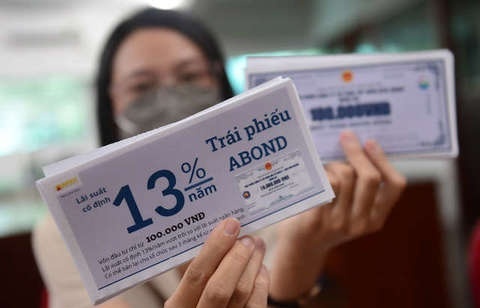

Despite the conflicting information surrounding corporate bonds, they still prove an alluring investment channel for idle capital sources.

Safely navigating choppy bond markets

October 20, 2022 | 08:00

With allegations against Van Thinh Phat Group causing turmoil in the corporate bond market, Nguyen Quang Thuan, chairman of the board cum CEO at FiinGroup, writes about bond default risks, bond maturity, and practical solutions to counter potential problems.

New regulation increasing transparency in corporate bond market

October 08, 2022 | 15:08

The government has promulgated Decree No.65/2022/ND-CP to amend and supplement Decree No.153/2020/ND-CP on corporate bonds. Decree 65 took effect on September 16.

Corporate bond market reform adds safety net for investors

September 29, 2022 | 10:03

The fresh and stringent legislative framework for the corporate bond market is slated to pave the way for a better debt sector in Vietnam, while the interests of issuers and investors could be safeguarded.

Long-term bond yields decline in emerging East Asia

September 16, 2022 | 09:32

Vietnam’s local currency bond market grew 8.1 per cent from the previous quarter to US$99.5 billion. The faster expansion was driven by both the Government and corporate bond segments.

Corporate bond market has ample room for improvement

September 14, 2022 | 14:48

The corporate bond market still has ample room for improvement, according to Nguyen Tu Anh, Director of the General Economic Affairs Department, Communist Party Economic Commission.

Legal basis for corporate bond issuance important for real estate sector

August 29, 2022 | 11:30

Building a solid and long-term legal basis for corporate bond issuance was an urgent solution to build a capital market for the real estate sector.

Constituting a healthy corporate bond market

August 12, 2022 | 19:53

Greater efforts are being exerted into instituting a transparent corporate bond market and radically tackling violations in corporate bond trading.

Increased inspections to improve corporate bond market

June 08, 2022 | 16:00

The Vietnamese authorities are keeping a grip on credit institutions’ corporate bonds in the face of growing scrutiny, which might add to pressure for issuers to alter their funding strategies. Investors’ confidence and rights, however, are to be strengthened.

Weighing up risks of a bubble from bond squeeze

June 02, 2022 | 08:00

The Vietnamese government has implemented a range of measures to control and tighten credit in real estate bonds. Broadly speaking, there are three channels of debt capital that the real estate sector can call on to secure credit: senior bank lending, the broader capital markets, and private credit.

Bond issuance slows amid tightening controls

May 29, 2022 | 09:00

Bond issuers have become more cautious amid the authorities tightening control of the market, leading to issuance shrinkages.

41 banks buy corporate bonds worth $11.9 billion

April 25, 2022 | 09:21

At a conference on April 22, Nguyen Thi Hong, Governor of the State Bank of Vietnam, said that credit institutions are direct investors in the bond market.

Investors tip-toeing around real estate risk

April 19, 2022 | 11:00

Vietnam is moving towards developing a balanced capital market and reducing the pressure on capital supply for banks – a process that requires dealing with internal problems such as corporate bond issuances as well as land-right auctions.

Real estate market heads corporate bond issuance as enterprises lean on loans

April 18, 2022 | 13:26

The bond market continues to be seen as a positive capital mobilisation channel for businesses and the economy, with some industries faring better than others in this regard.

Tan Hoang Minh would sell 2-3 properties to pay back to bondholders

April 14, 2022 | 16:29

Do Hoang Minh, chairman of property group Tan Hoang Minh, revealed that the corporation would offload 2-3 projects to ensure bondholders’ rights and obligations.

Mobile Version

Mobile Version