Weighing up risks of a bubble from bond squeeze

June 02, 2022 | 08:00

The Vietnamese government has implemented a range of measures to control and tighten credit in real estate bonds. Broadly speaking, there are three channels of debt capital that the real estate sector can call on to secure credit: senior bank lending, the broader capital markets, and private credit.

Bond issuance slows amid tightening controls

May 29, 2022 | 09:00

Bond issuers have become more cautious amid the authorities tightening control of the market, leading to issuance shrinkages.

Vietnam’s corporate bond market to reach 20 per cent of GDP by 2025

April 13, 2022 | 16:00

The Vietnam Bond Market Association estimates that outstanding the debt of the corporate bond market reached 15 per cent of GDP at the end of 2021.

Leaders eye bond market revamp

April 13, 2022 | 09:57

The recent cancellation of new corporate bonds has sparked a public discussion about the dissemination of misleading information and the multiple hazards lurking in the debt market

Techcombank named the most active market maker for government bonds

January 17, 2022 | 20:27

Techcombank scooped up the first place among market makers of government debt instruments in 2021, as recognised by the Ministry of Finance.

Turbulence expected after Fed pivot

December 21, 2021 | 09:42

Emerging economies like Vietnam will not be immune to plans by the US Federal Reserve to reduce bond purchases and rate hikes to fight against inflation pressures, with foreign indirect investment and some import- and export-reliant businesses perhaps in the firing line.

Fruitful territory for bond issuance

November 25, 2021 | 12:08

Banks are showing strong desire in bond issuance activities, while real estate developers have lowered the extent of their bond-related capital mobilisation efforts.

Investors cautioned over bond issuance vulnerabilities

October 07, 2021 | 14:00

Credit-challenged companies, especially banks and real estate providers, are finding another way around their continuous capital needs by tapping into the corporate bond issuance market, which remains particularly vulnerable to economic downturns and incomplete legal frameworks in Vietnam.

Bond issuance power play in energy sector

October 13, 2020 | 22:55

With vast potential and attractiveness, investors are very much keen to increase their foothold in the energy sector by expanding their operations, with the demand for fund mobilisation via corporate bond issuance burgeoning in Vietnam.

Government urges caution on corporate bond risks

September 12, 2020 | 08:00

According to SSI Securities Corporation, the value of corporate bonds issued in 2019 was VND280 trillion ($12.17 billion) – an on-year increase of 25 per cent from 2018.

Risk and thirst abound in bond market

August 19, 2020 | 18:00

Both local and overseas companies have ventured back into the bond market to cash in on low interest rates, but Vietnamese authorities are cautioning investors.

F88 distributes $8.7 million worth of bonds through three rounds of issuance

July 16, 2020 | 11:19

F88 completed three rounds for bond issuance worth VND200 billion ($8.7 million) with the annual interest of 12.5 per cent.

BIDV Securities Company (BSC) races to achieve stellar profit in 2020

July 01, 2020 | 11:17

BSC announced expectations of powerful profit at its 2020 AGM, with brokerage and margin lending activities envisaged to be the key revenue drivers.

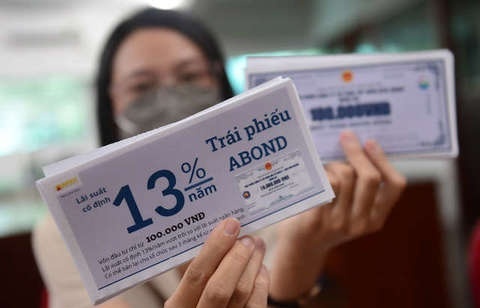

Corporate bonds lure individual investors

May 01, 2020 | 22:38

The corporate bond market attracted double the number of individual investors in the first quarter of this year compared to 2019.

Masan Group to mobilise $434.78 million through bonds

December 26, 2019 | 17:20

Masan Group will issue 100 million bonds worth VND10 trillion ($434.78 million) altogether, with a maximum term of 36 months to expand its business, lending to its unit, and repay a loan.

Mobile Version

Mobile Version