|

| His vision was to change the course of the country’s financial landscape and provide investment opportunities for all. His atypical strategic choices have changed the company’s trajectory, leading it to grow from strength to strength. TCBS works like a fintech and over 65 per cent of its employees are tech engineers. It leverages online distribution and its parent company’s physical distribution with no broker networks. In 2021, TCBS maintained its leading position among securities companies with more than $165 million in pre-tax profit despite not being a prominent player in equities. TCBS is the prime player in corporate bonds, holding this position for six consecutive years and moving to become the fourth-largest player in equity brokerage. |

|

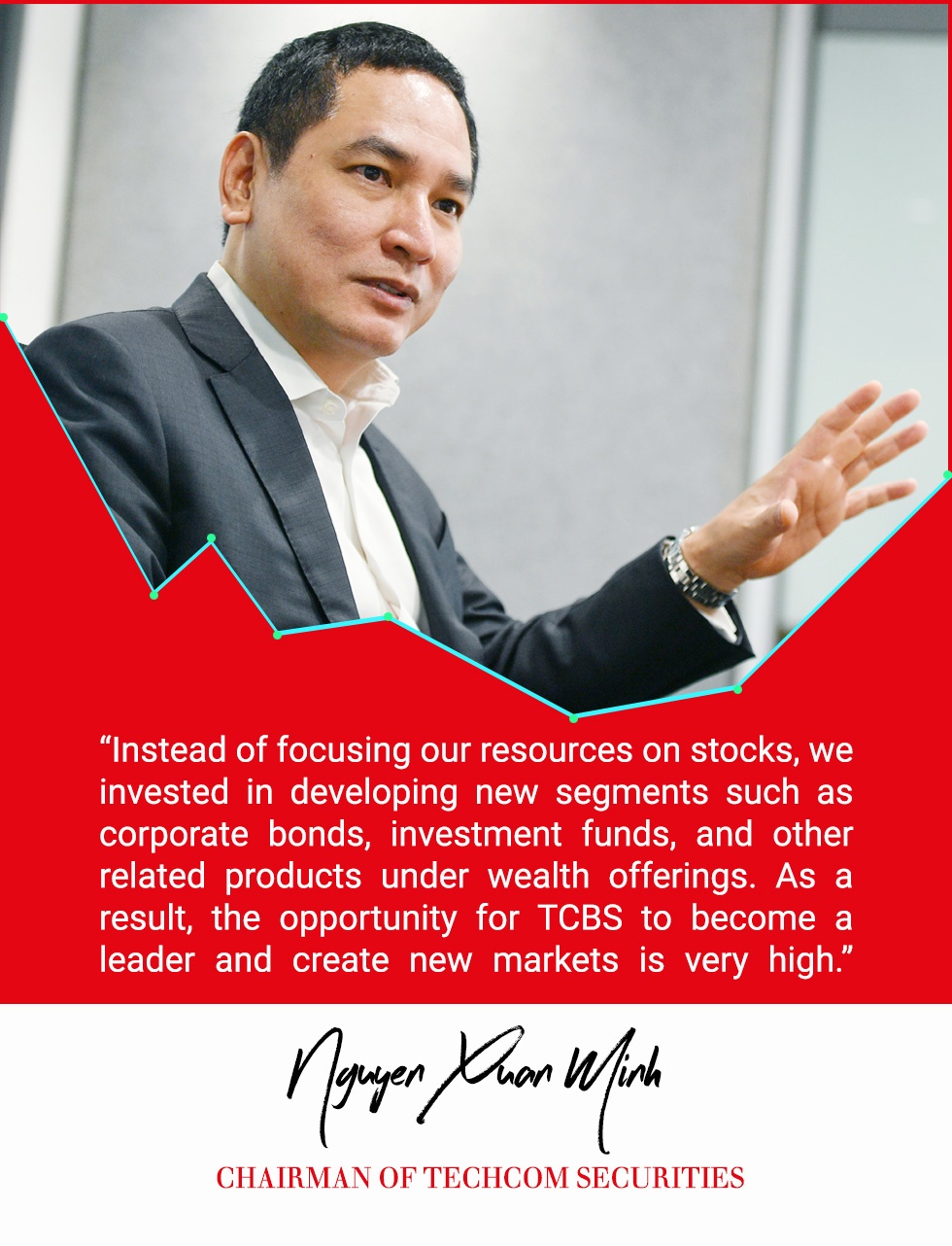

| About 15 years ago, Minh decided to quit his job at Franklin Templeton Investments – a large fund management company in Singapore – to return to Vietnam to set up a business. With many years of experience, he saw untapped potential in emerging frontier markets that were in their nascent stage of development. “Vietnam is a fast-growing economy with a young and literate population. The country had investment needs but did not have many options at that time. People mainly put their savings in gold, dollars, or real estate. Access to financial products was limited so this prompted me to return to Vietnam to build something for myself and the society rather than merely continuing to work as a salaried worker abroad,” Minh said. Upon returning to Vietnam, he co-founded Vietnam Asset Management Ltd. to mobilise foreign capital investments in Vietnam. He built this company for eight years before one conversation changed the course of his career and his life. This conversation led him to take on the role of chairman of the Board of Directors at Techcom Securities and head of Techcombank (TCB) Investment Banking Division |

|

| What drove TCBS’ growth from being unknown to becoming a market leader? Established in 2008, TCBS was a small company focused largely on operations up until 2013. At that point, we had a choice to invest in equities and compete with all others or look for uncharted territories and opportunities that could drive growth and build new markets for Vietnam. We were not even on the map and were starting from ground zero. At that time, we made three bold strategic choices. Our first choice was to offer a set of products that differentiated us from the market. When we looked at the countries surrounding Vietnam, we found that on average people only spent about 20-25 per cent on stocks and put the rest into other asset classes. This led to a large and untapped potential for TCBS to access. We also discovered at that time that bonds and investment funds (domestic open-ended funds) were still a very new type of investment in Vietnam which had never been done before. Instead of focusing our resources on stocks, we invested in developing new areas such as bonds, investment funds, and other related products, which were offered as wealth management solutions. As such, the opportunity for TCBS to become a leader when creating new markets was very high. The second strategic choice was to build a distribution system that is not reliant on brokers. Most companies have large broker networks; however, TCBS choose not to go down that path. Instead, we took to building an online presence and leveraging the physical network of our parent company, which turned out to be a huge competitive advantage. Compared to SSI, VNDirect, HSC, and Ban Viet, we have a very strong branch system and staff from the parent bank. We knew that we had to take advantage of this strength immediately. At that time, Techcombank had about 300 branches and several hundred senior priority advisors, which became a different and very strong channel for TCBS. Our third choice was to invest in technology. It is not about an app, but more about building a core technology platform consisting of three main elements. The first is building a strong bench of tech-related employees, the second is operational technology and automation, and the last is data lakehouse. Building this technology platform took a lot of time, effort, and painful experience. We later built TCBS like a fintech, with about 65 per cent of the total staff being tech engineers. More importantly, as we were executing these strategic choices we heavily invested in building one of the best talent benches in the industry. |

|

| What was it like starting the bond business 10 years ago? By that time, bonds were a new concept that was very new to our customers. We had to face many hurdles and serious endeavours were needed to build this space. For starters, we had to educate both issuing organisations and investing customers on the benefits of bonds. These were very new concepts. Customers mainly deposited savings but very few people knew about bonds. Secondly, we needed to support organisations through the bond issuance process. Finally, it was essential to set up infrastructure and processes at TCBS to issue and structure solutions to meet people’s needs. I remember the first day when customers came to buy bonds, they had to sign up to seven times on various contracts and forms. Now all these processes are made online and digitalised. Customers do not need to come in person anymore and can even complete transactions by themselves without a consultation. |

|

| What has helped TCBS maintain its leading position for six consecutive years despite the fierce competition? If you stand still, you are essentially falling behind and competitors will catch you up. Bond products are something others can do and they have the ability to advise and distribute products to customers. Now, the competition in this segment is intense and it is increasing because when competitors see an attractive market, they want a piece of it as well. However, we want to continue to break away from the competition and widen the gap each year. TCBS doesn't have a defensive mindset to stop others. TCBS has always been a pioneer in many bond issuance advisory services. In the past, bonds were basically considered a loan, but we became the pioneer in listed bonds on the securities market and then moved into unsecured bonds for large institutions. Following this, we also pioneered as an advisory on the issuance of guaranteed bonds for organisations such as the World Bank and bonds with maturities of up to 10-15 years by working with organisations that have AAA international credit ratings. At that time, issuing advice was much more difficult. It was not simply about bonds and yields anymore but also involved product packaging. From 3-5 basic products, we can create products with several combinations such as stocks with bonds and with derivatives to meet customers’ needs. This is difficult for competitors to replicate. And another very important competitive advantage of TCBS is technology. We have built a financial technology ecosystem that helps create many new, interesting, and complex offerings that suit the needs and behaviour of customers but without excessive investment costs. |

|

| Currently, there are quite a few companies with problems with bond issuance terms when buyers want to resell before maturity. What did TCBS do to reduce problems? The important thing is that if we get to know our customers well and deliver the right products. Then, there won't be a high demand for sale-backs before maturity. To understand customers and insights, you must analyse data. This is a factor that determines the competitiveness of companies in the next five years. Regarding data, TCBS has grown from a data warehouse to data lake and now lakehouse. Storage and computing capabilities have gone to the cloud with a multi-cloud strategy to increase business flexibility as well as scalability. In the last two years, thanks to following its own model, TCBS has developed a key roles, such as data scientists. They are not only financially savvy but also have statistical probabilities and programming skills to create models from analysed data sources. We are now scaling our data scientists’ skills across all teams to create a new level of tech finance and data analytics. This will help TCBS better understand customers, giving them the right products according to their needs. When you sell 2-3-year bonds to customers who want to hold 2-3 years and 6-month bonds to customers who have real 6-month needs, they will not sell before maturity anymore. |

|

| TCBS initially chose a no brokerage and stocks model, but then entered the list of top companies in this sector. What has caused this success? About 7-8 years ago, TCBS had no advantage in the stock market. As a late entrant, we had to learn about the market and business models and choose a different direction. However, our advantage over competitors was technology. TCBS has built a good technology platform, helping to develop new solutions for stocks that are better than the average in the market. Like TCBS’ app TCInvest, there are many new features that are not available anywhere else, such as iCopy – the first community investment platform in Vietnam and also a new way to invest in securities. Last but not least, securities is an investment channel that requires very strong data capabilities, and TCBS has developed many modern data models with machine learning and other advantages that provide useful information to customers. |

|

| Since the beginning of the year, the stock and bond markets experienced many challenging developments. How will this affect TCBS' business plan in 2022? The stock market went down, liquidity decreased, and revenues were affected. But in difficult times, we have to find ways to think, stay creative, and increase market share. And this is what we did. In early 2020, TCBS' market share was only about 0.6 per cent and then it increased to 5.5 per cent. During a period of some market turmoil, we were more focused on building something for the next stage of development, further refining some of our products. To put it simply, TCBS previously had a 1-lane infrastructure and was silently building 3-4 more lanes to anticipate future demand. We have turned the challenging market period into a time to prepare for bigger plans, with higher goals. It is the difficulty that opens up new opportunities for TCBS. After crises, organisations with good capabilities and foundations quickly overcome these and become stronger. Therefore, in 2022, we do not see the need to adjust the plan. The business plans were completed in the first two quarters of this year. In the past five years, TCBS has steadily grown at about 45 per cent per year. In the next five years, we plan to be around 25-30 per cent because the company's size is also large, so the growth number will decrease a bit. Currently, 65 per cent of TCBS employees are technology engineers and operate more like a fintech than a traditional securities company. Based on the initial strategy of focusing on investment in technology, how did you imagine the current model? To be honest, we didn't even imagine it. At that time, we only knew that we chose to invest in technology, so I guess it was imperative that employees too need to be technologically savvy. When building automated operating processes, there were many projects that needed to be implemented. Using a waterfall model would have led to queues and delays in implementation. That's why we chose the agile model often used by technology companies when developing products to accelerate progress. By doing so, every department had IT engineers to jointly develop projects. Along with that, TCBS engineers would sit together with financial personnel to cross-study each other's knowledge. This helped us to train employees with both technical and financial knowledge, helping to accelerate the project thanks to mutual understanding when developing products and systems. |

Can you share some numbers that show the rapid growth of fintech projects inside TCBS? Can you share some numbers that show the rapid growth of fintech projects inside TCBS? TCBS currently has about 32 scrum teams that combine technology and business to work on a project. On average, these teams complete about 1,000 large and small projects a year. This number has been maintained for nearly three years now. Almost every Friday at 5pm, there is a 'go live' festival at TCBS at which teams line up to release new products, systems, and automated processes. The number of such projects also shows how fast we can release new features, as well as how well we can improve our products and create great competition for TCBS in terms of financial technology products. Your starting point was finance, not technology. What has helped TCBS to successfully develop into a fintech company? First, the leaders, then the employees, must always have the spirit of self-development. For example, you may not know programming, but at least you have to understand what technology is and what can be done for you to improve the work you do. More than eight years ago, the senior leaders of TCBS did not know what the agile model was, but then we read and learnt about it. After studying, we talked with our IT colleagues to learn more and started working together. Almost all IT engineers also did not know anything about securities. We also do not have a policy of recruiting experienced people from other securities companies, but most of them are new employees with strong qualities and spirit, and they then learn together. At TCBS, we create an open, flat environment, without many hierarchies, so the opportunity to learn from each other is abundant. Good technology engineers from other companies come to join us and learn a lot about financial and securities knowledge when developing products while financial professionals also learn many things about technology. When you work with people who are always passionate and eager to conquer new heights, you will always want to achieve more challenging goals. This is why TCBS was able to grow from an ordinary securities company into a fintech with many outstanding financial technology products, simply because those are the goals to be achieved. |

|

| How did TCBS and Techcombank use synergies to accelerate growth? When a team works closely together, it creates resonance. Hence the question to ask is do teams working together see each other as necessary to complete the task? Techcombank does not consider TCBS a subsidiary but a team that can work well together to develop new opportunities and markets. That is the first step. The second step is that we promote the online channel and do not use any brokers. We make it possible by building a solid technical foundation. Regarding technology, the core system between securities companies and banks is different and some things cannot be combined. However, with each entity building its core technology platforms and potential connections, it helps to serve customers better. The connection system between the two parties helps customers make transactions at TCBS without having to transfer money from their bank account to their securities account. The money is still safely kept in the bank and is only transferred when customers have a transaction to make. |

|

| How did TCBS work with Techcombank without increasing the risk for the bank? There are a few points that one needs to consider. One, TCBS has no proprietary stock trading, hence it is less prone to equity index fluctuations. This has a flip side as well, as when the markets are good, other securities companies make a lot of money from self-trading while TCBS still only makes 10 per cent from its bond investments. However, this is done very safely. Two, this also stems from choices made by TCBS' Board of Directors. Participating in stock investments with customers can cause conflicts of interest and lead to a loss of objectivity in our services. Hence, we chose not to do this. This is just a choice, it’s not right or wrong. From TCBS' perspective, this strategy helps us create safety and stability to focus on developing differentiated financial products and monetising them. Three, Techcombank’s culture is one of being cautious in everything we do. We are a leading joint stock bank following international standards for safety, security, and standard processes that are closely supervised. We learned that in 2013 when we embarked on our journey with the bank. At the same time, we adopted agile methods and a startup mindset to accelerate execution and create a competitive advantage in the market. So far, we have found the right balance to work in tandem with each other, learn from each other, and leverage our strengths to drive synergies. |

By Tuan Khanh

By Tuan Khanh

|