Advanced search

Search Results: 837 results for keyword "State Bank of Vietnam".

Tight outlook with new offshore borrowing rules

25-07-2023 11:22

On June 30, the State Bank of Vietnam (SBV), in an effort to address loopholes in previous regulations and offer a more comprehensive framework for non-government guaranteed offshore borrowing, issued Circular No.08/2023/TT-NHNN to replace Circular No.12/2014/TT-NHNN from August 15. Circular 08 has been adopted with significant changes compared to Circular 12.

“Substandard” banks failing with cross-ownership norms

18-07-2023 10:04

Amidst rising concerns over cross-ownership practices in Vietnam’s rapidly evolving banking sector, experts are calling for effective mechanisms to ensure the independence and competency of board members, stringent sanctions, and better regulations on ownership ratios to bolster corporate governance.

Credit bubble risk reality as banks hit lending capacities

18-07-2023 08:00

The availability of cheap capital has the potential to fuel subprime projects and activities, leading to a credit bubble risk for the economy.

SBV raises credit growth target to counter economic headwinds

11-07-2023 12:09

In a move that underscores its proactive policy stance amidst the prevailing economic challenges, the State Bank of Vietnam (SBV) disclosed on July 10 an adjustment to the credit growth target for its credit institutions (CIs) to an estimated 14 per cent across the board.

Positive developments in the real estate market

05-07-2023 16:22

The SBV has received 24 social housing initiative applications for a $5 billion loan package in six provinces, including 15 social housing projects in the provinces of Bac Giang, Tra Vinh, and Tay Ninh, and nine projects in the provinces of Binh Dinh, Phu Tho, and Ba Ria-Vung Tau.

SCB announces branch closures amidst restructuring

03-07-2023 18:13

Saigon Commercial Joint-Stock Bank (SCB) is closing several branches as part of its restructuring efforts. The bank has reassured customers that their rights and transactions are guaranteed, and that it is complying with directives laid out by the State Bank of Vietnam (SBV).

Central bank asks credit institutions to reduce interest rates

03-07-2023 17:05

The State Bank of Vietnam (SBV) has sent a document to credit institutions and branches of foreign banks and SBV in provinces and centrally-run cities regarding the reduction of interest rates.

Interest rate cut contributes to supporting economic growth: economists

26-06-2023 11:57

The State Bank of Vietnam (SBV) has cut regulatory interest rates for four consecutive times since the beginning of this year, in the context that world interest rates continue to rise and stay at a high level.

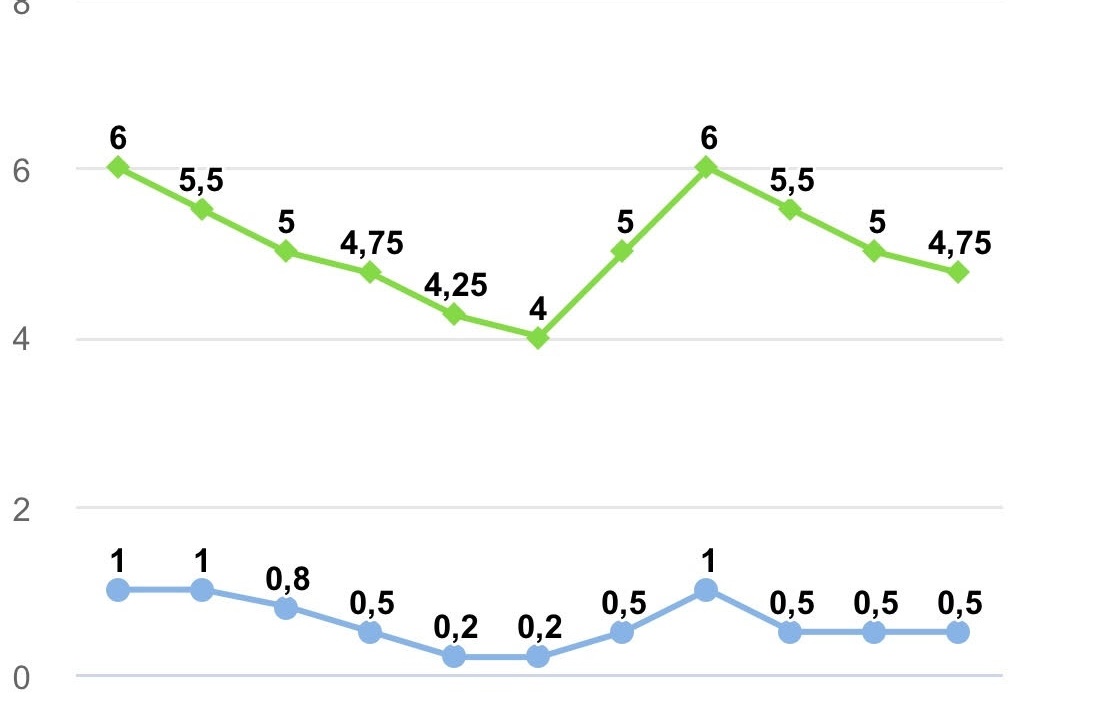

Savings interest rate cut to 4.75 per cent

16-06-2023 08:00

The State Bank of Vietnam (SBV) has reduced the ceiling interest rate for savings under six months to 4.75 per cent a year, the second reduction in less than a month.

Further fall projected for interest rates

13-06-2023 09:27

Several banks have followed the State Bank of Vietnam’s (SBV) lead by lowering their base interest rates, aiming to encourage and facilitate increased credit demand within the market.

Vested interests doing damage in banking

12-06-2023 12:19

Concerns are being raised by various stakeholders in Vietnam’s banking sector regarding the risks of cross-ownership, emphasising the need for regulatory reforms to enhance transparency, mitigate the dominance of major shareholders, and propose measures such as reducing ownership ratios and expanding information disclosure.

Policy interest rate expected to further reduce in H2 2023

09-06-2023 16:38

The analysts also expect the average 12-month deposit interest rate will drop to 7 per cent per year in 2023.

Interest rate cuts alone deemed insufficient

06-06-2023 15:00

Members of the business community and experts are weighing up the diverse aspects of interest rate reductions, focusing on measures to ensure future growth.

SBV Governor explains high lending rates, credit room management

01-06-2023 17:17

Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong provided explanations regarding the high lending rates and credit room management during a plenary session of the 15th National Assembly’s ongoing fifth meeting in Hanoi on June 1.

BVBank builds stronger identity with new name

31-05-2023 09:58

BVBank, formerly known as Viet Capital Bank, has received approval from the State Bank of Vietnam (SBV) to change its English name abbreviation as part of its strategy to enhance its customer-centric services and establish a stronger brand identity.

Mobile Version

Mobile Version