UOB maintains positive outlook for Vietnam but risks lie ahead

11:11 | 13/03/2025 Print Article

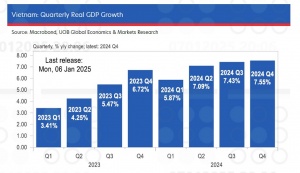

The United Overseas Bank (UOB) has maintained its full-year growth forecast for Vietnam at 7 per cent in 2025, assuming first quarter growth of 7.1 per cent.

|

For 2026, the bank anticipates the expansion pace to step up to 7.4 per cent, benefitting from the government's efficiency drive.

With surprisingly strong performances in three straight quarters, Vietnam’s economy expanded 7.09 per cent in 2024 from 5.1 per cent in 2023, beating the consensus call of 6.7 per cent and official target of 6.5 per cent. This was the best showing since the post-COVID rebound in 2022 (8.1 per cent).

The manufacturing and services sectors were the main drivers of activities in the last quarter of 2024, while external trade maintained a strong pace through most of 2024. The upswing in semiconductor sales since mid-2023 also boosted exports.

Export activities expanded for the 10th month in 2024, registering a full-year gain of 14 per cent, and reversing the 4.6 per cent contraction in 2023. Imports rose 16.1 per cent in 2024 to deliver Vietnam’s second-largest trade surplus of about $23.9 billion, following the record high of $28.4 billion in 2023. This is the ninth consecutive year that Vietnam has registered an annual trade surplus, which will be helpful in anchoring the VND exchange rate, UOB affirmed in the report released on March 12.

Vietnam's heavy dependence on international trade is reflected in the roller coaster ride of economic growth over the 2023-2024 period, when falling exports in 2023 caused a significant slowdown to the headline GDP. The boom in exports in 2024 resulted in its strongest economic performance since 2022. Vietnam’s export value was about 90 per cent of GDP in 2024, the second highest in ASEAN after Singapore’s 174 per cent and ahead of third-placed Malaysia’s 69 per cent.

This high degree of openness means that Vietnam is vulnerable to disruptions and frictions in international trade, especially with US President Trump’s focus on trade imbalances. Overall, the US trade deficit with ASEAN nearly tripled to $228 billion in the same period as global trade flows and supply chain shifts accelerated in response to trade restrictions implemented in the Trump 1.0 era.

Vietnam’s National Assembly has raised the country’s 2025 growth target to at least 8 per cent and is targeting double-digit growth from 2026-2030, but most forecasts remain at 6.5-7 per cent. "While 8 per cent or higher growth rate is possible, exports and manufacturing will not be sufficient to drive this outperformance," the UOB asserted.

Additional capital expenditure, particularly from public investment, will be needed to stretch further as well as to buffer against any potential downturns in trade. Vietnam's capital investment ratio has stayed around 30 per cent of GDP at least over the past decade. In contrast, China's gross capital formation has stayed consistently above 40 per cent in the same period. This suggests that Vietnam has been underinvesting relative to its large neighbour and there is certainly a case for higher public investment, particularly with the government aiming for double-digit growth.

"Taking into account the above factors, we remain cautiously positive about Vietnam's outlook," UOB reported.

With economic growth staying robust in 2024 and into 2025 and the US Fed poised to hold steady, there is less urgency for the central bank to hurry into any policy easing. At the same time, inflation ticked higher to 3.6 per cent in 2024 from 3.26 per cent in 2023, though still below the 4.5 per cent threshold.

However, with the prospects of further trade tensions globally under Trump 2.0 and the accompanying US dollar strength an emerging concern, the SBV is expected to stay alert to downside pressures on the VND. As such, the best course of action currently is for the key refinancing rate to stay at 4.5 per cent, according to the UOB.

The VND weakened to a record low of about 25,600/USD in early Mar after the SBV raised its USD sale prices to banks to 25,698/USD from 25,450/USD, the first increase since last October. From here, the path of resistance is still biased towards further VND weakness due to China's growth and tariff uncertainties, UOB said.

There is a risk of the US imposing tariffs on Vietnam, owning to the latter’s sizeable and growing trade surplus with the US. Potential tailwinds to offset VND depreciation pressures include a strong domestic growth outlook and the SBV’s pledge to ensure a stable exchange rate.

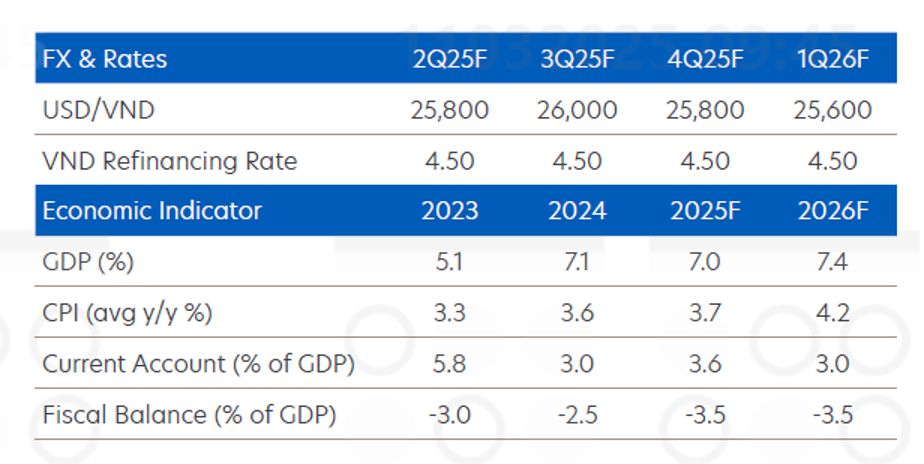

Overall, the UOB's updated USD/VND forecasts are 25,800 in 2Q25, 26,000 in 3Q25, 25,800 in 4Q25, and 25,600 in 1Q26.

| Economic expert shares view on 8 per cent GDP target Phan Duc Hieu, senior expert and member of the National Assembly Economic Committee, examines ways to achieve a GDP growth target of 8 per cent or more this year, as set by the government, and envisions the possible obstacles ahead. |

| Overseas investment a boon to manufacturing sector An increase in foreign investment in the manufacturing sector has been the driving force for Vietnam's solid economic growth, according to experts at Global and Vietnam Outlook 2025, organised by Standard Chartered Bank Vietnam in Ho Chi Minh City on January 20. |

| Public investment may contribute 1 per cent to GDP growth A 40 per cent increase in public investment could add 1 per cent to GDP growth in 2025; however, implementation may be difficult due to remaining bottlenecks. |

| Vietnam may struggle with new GDP growth rate target of 8 per cent A United Overseas Bank expert has urged caution about Vietnam's 2025 growth target of 8 per cent given the uncertain environment. |

Nguyen Huong

Post path: https://vir.com.vn/uob-maintains-positive-outlook-for-vietnam-but-risks-lie-ahead-124453.html