Virtual insurer OneDegree raises $27 million for Asian expansion

|

The funding round to support its expansion in Asia and investments in AI was held on June 29. The investment came from global financial institutions as well as existing backers such as Gobi Partners, BitRock Capital, and Sun Hung Kai & Co, according to Bloomberg.

The company's co-founder Alvin Kwock mentioned that the new investors will be announced later due to a strategic partnership.

Initially focused on pet insurance, OneDegree has expanded its offerings to include parcel, fire, home, and health insurance. It also provides coverage for digital assets against hacking, malware, and theft. The firm raised $28 million in a funding round last year and anticipates the need for another round before considering an initial public offering.

Kwock stated that based on their schedule, they expect to generate a profit by the end of 2024. Despite being approached for a SPAC listing, the company plans to go public only after achieving a larger business scale and turning profitable.

OneDegree experienced an underwriting loss of HK$74.4 million ($9.5 million) in 2021, an increase from HK$28.1 million (around $3.6 million) the previous year, according to the Insurance Authority. The demand for digital asset insurance is growing rapidly in Hong Kong as it aims to establish itself as a hub for the crypto industry.

The Securities and Futures Commission, the market regulator in Hong Kong, requires insurance coverage for firms to obtain a virtual asset trading platform licence. OneDegree has already received over 100 inquiries for digital asset insurance this year, with half of the potential clients located outside Hong Kong.

Recently, OneDegree entered into a partnership to integrate Microsoft's AI service into its automated chat box and cybersecurity solutions.

Bloomberg also mentioned that OneDegree has been providing its technology platforms to insurance companies in Malaysia, Taiwan, and Vietnam, and is now aiming to expand further across Asia and into the Middle East.

Founded in 2016, OneDegree is part of a new generation of insurers that is reimagining the industry with technology.

The company stated, "We are one of the first in Hong Kong to receive a virtual insurance licence. Our mission is to make insurance simple, transparent, and do what it was always meant to do – protect us from the risks that come with life, whether big or small."

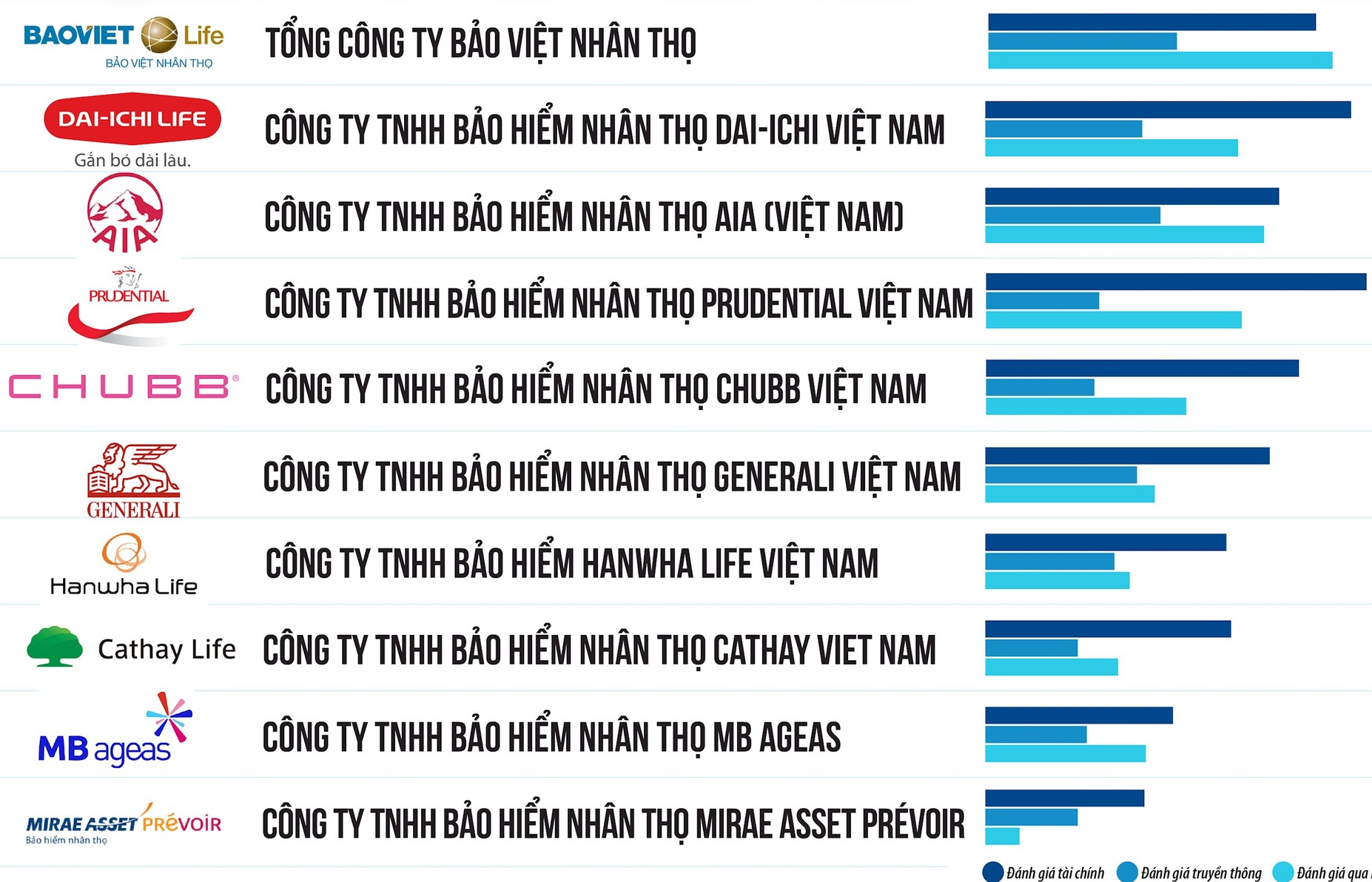

| Vietnam Report reveals Top 10 insurance companies in Vietnam in 2023 Vietnam Report has just released its highly anticipated list of the 10 most reputable insurance companies in Vietnam for 2023. The list encompasses two categories, life insurance and non-life insurance. |

| Insurers to face penalties for wrongdoing in bancassurance sales The Ministry of Finance (MoF) inspection reveals regulatory violations by Prudential, MB Ageas Life, Sun Life, and BIDV Metlife in their bancassurance sales practices, leading to impending penalties and increased scrutiny in the Vietnamese insurance market. |

| Generali Vietnam honoured at awards ceremony Generali Vietnam has been honoured at the 'Top 100 best products and services for families and children' awards for its pioneering education-focused, unit-linked insurance solution, 'VITA – Cho Con'. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- PangoCDP bags $1.5 million in seed funding round (October 30, 2024 | 11:39)

- Coolmate wraps up $6 million Series B funding led by Vertex Ventures (October 30, 2024 | 10:49)

- Singapore's M1 acquires 70 per cent stake in Vietnam’s ADG (October 29, 2024 | 14:44)

- M&A figures can be rejuvenated through stability (October 17, 2024 | 15:38)

- Keppel sells stakes in Saigon Sports City and Saigon Centre (October 02, 2024 | 13:36)

- Nutifood acquires majority stake in KIDO Foods (September 23, 2024 | 20:27)

- Traditional M&A entities buoyed by positive outlook (September 20, 2024 | 17:43)

- UK-based Cedo acquires Vinatic Recycling Company in Vietnam (September 17, 2024 | 17:42)

- Scatec to sell Dam Nai Wind Farm to SAETF (September 13, 2024 | 14:56)

- Dat Bike secures $4 million convertible loan (August 27, 2024 | 17:25)

Tag:

Tag:

Mobile Version

Mobile Version